How much capitalism is optimal for economic growth and stability? Or, equivalently, the question is how much socialism or government? Until now, no one appears to have posed this question, as most people tend to favour more and more of one or the other, in a political rather than scientific judgement. This post provides some tentative answers based on empirical evidence.

Under our definition, no economy is purely capitalist, because there is always a government which expropriates private property through taxes for government purposes; hence there are only degrees of capitalism. The degree of capitalism and the size of government are two sides of the same coin, as more capitalism means less government and vice versa.

A previous post showed that, from International Monetary Fund (IMF) data, more capitalism and less government resulted in higher economic growth for 40 countries, between 2003 and 2012. Bigger governments, as measured by total expenditure as a percentage of Gross Domestic Product (GDP), on average, reduced annual GDP growth rate by about 1.5 percent for every ten percent increase in the size of government.

Therefore, purely for economic growth, the empirical data suggest more capitalism is better. Classical, neoclassical and Austrian schools of economics have always favoured limited government, but have not offered any clear guidance on reasonable limits. Governments perform many necessary social functions which individuals cannot do, will not do or only do inefficiently. Among these functions, the most important for capitalism is the protection of private property rights, involving security and law enforcement.

Other important government functions include management of the commons and protection of the environment. Many other functions such as health, education and social welfare are more controversial in relation to the desirable extent of government involvement. Ultimately, the size and scope of government are political decisions with ethical and moral dimensions, which, while important, are always changing with evolving collective preferences.

But less prone to change are the positive (as opposed to normative) economic consequences stemming from the choice of the size of government. The relative constancy in positive economics comes from the relatively stable statistical relationship, cited above, that smaller government is correlated with stronger economic growth. Whatever useful social functions a government may perform, it comes at the expense of individual citizens whose incentive to produce and to innovate may be compromised by government expropriation.

In this post, the question of how much government is economically sound will be examined, based on empirical observations that appear to show some natural constraints due to limits to government finances. Government expenditure which defines the size of government and the level of capitalism is financed in two main ways: current taxation and government budget deficits, which may be viewed as future taxation or indirect taxation from future inflation.

Ricardian Equivalence

Classical and neoclassical economics assume that the two main ways of financing government expenditure have the same impact on consumption and economic growth. This assumption, called Ricardian Equivalence (Buchanan, 1974; O’Driscoll, 1977; Barro, 1989), is based on the belief that increases in government spending are compensated by off-setting decreases in consumer spending because rational consumers can anticipate future consequences of current government policy.

Therefore, it does not matter whether government expenditure is increased through raising taxes or through issuing government bonds to finance budget deficits, as the policy has no lasting effect on aggregate demand or economic growth. A completely opposite tenet of Keynesian economics assumes that the government could stimulate aggregate demand by increasing government expenditure.

In a new Keynesian compromise of the worst of both worlds, it is now widely accepted in mainstream economics that stimulation of aggregate demand works in the short-term, in agreement with Keynes, but is neutral with no lasting effect in the long-term, in agreement with neoclassical economics. This pluralist theory provides the perfect licence for reckless short-term policy to try to banish economic fluctuations.

This unscientific “new Keynesian synthesis” is responsible for the current economic crisis, because fiscal stimulus through government budget deficits has failed in the short-term, as noted recently by Barro and Redlick (2009), and it has been non-neutral and harmful in the long-term, as shown in a detailed study of the US economy (Sy, 2016b).

The reason that economists have failed to see the harmful impact of government is due to the simple fact that their economic models do not include explicitly an autonomous government sector. The government sector is assumed either irrelevant or its impact can be captured fully by simple tax and fiscal rules in the models (Mayer et al., 2010; Sbordone et al., 2010). Essentially it is assumed that the government cannot do much good or harm with tax or budget deficits.

That Ricardian Equivalence is false follows from the simple empirical fact that a larger government leads to lower economic growth across many countries. Fiscal stimulus from lowering tax revenue leaves the size of government unchanged, whereas fiscal stimulus from increasing government budget deficit increases the size of government. Thus fiscal stimulus from tax reduction is neutral to growth whereas fiscal stimulus from budget deficit is depressive to economic growth.

The fact that budget deficits are harmful to economic growth is true not only across countries over a ten-year period, as will be detailed below, it was shown (Sy, 2016b) to be true also for the US economy over several decades since the Second World War (WW2).

A previous US study (Sy, 2016a) shows that, as the size of the US government increased in a creeping American socialism, government expenditure increased from a post-war low of 20 percent of GDP to a high of 36 percent in 2010. The US economic growth rate trended down from about four percent per annum to two percent in recent years.

The increases in US government expenditure to stimulate personal consumption were financed by borrowing, leading to persistent budget deficits and expanding public debt. The secular accumulation of public debt had resulted from the budget deficits which were not self-liquidating because those budget deficits led to lower, instead of higher, economic growth contrary to expectations from Keynesian theory. That is, the accumulation of large public debt came from failed attempts to stimulate economic growth through budget deficit spending.

Data Selection

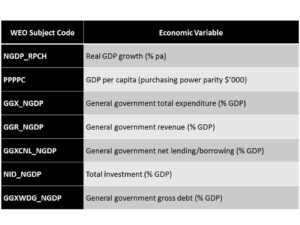

As in the previous post, the data come from the IMF macroeconomic database which is used in its World Economic Outlook (WEO) reports. Defining the size of government by government total expenditure as a percent of GDP, the 40 largest economies averaged over the ten year period (2003-2012) have been selected initially.

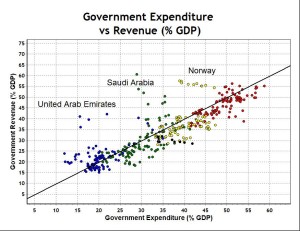

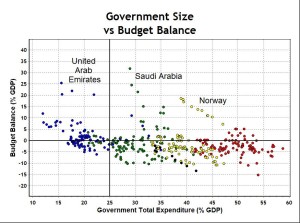

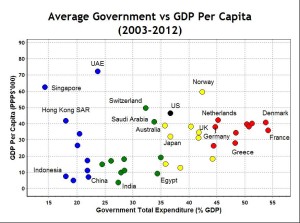

To make a final selection of countries for the study of the impact of government, the following economic variables have been studied to spot any anomalies or abnormalities.In the following scatter-plots, charts with a large number (400) of dots usually represent ten-years (2003-2012) of data for 40 largest economies, while charts with a small number (40) of dots represent ten-year averages of the 40 largest economies. The blue dots represent the bottom quartile of countries in terms of size of government (measured by average government total expenditure), while the green, yellow and red dots represent succeeding quartiles. The black dots represent the US, the largest economy in the world.

To make a final selection of countries for the study of the impact of government, the following economic variables have been studied to spot any anomalies or abnormalities.In the following scatter-plots, charts with a large number (400) of dots usually represent ten-years (2003-2012) of data for 40 largest economies, while charts with a small number (40) of dots represent ten-year averages of the 40 largest economies. The blue dots represent the bottom quartile of countries in terms of size of government (measured by average government total expenditure), while the green, yellow and red dots represent succeeding quartiles. The black dots represent the US, the largest economy in the world.

The following chart is a plot of government budget, where the diagonal line represents cases of balanced budget, with government expenditure equalling government revenue.

The above chart shows most dots falling below the diagonal line indicating that most countries run annual government budget deficits. The outliers are groups of dots far above the diagonal line representing three countries running large annual budget surpluses. Of course, these are major oil producing countries collecting windfall oil revenue. Except for these countries, plotting the same data differently, it is evident from the chart below that large-size governments, with expenditures greater than 25 percent GDP, are more likely to run budget deficits.

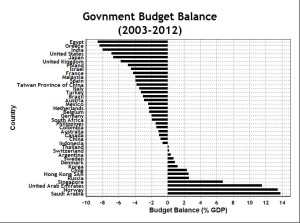

Saudi Arabia, Norway and United Arab Emirates are outstanding in terms of average government budget balance, as the following chart makes clear.

Since the government budget balances of large oil-producing countries are anomalies representing accidental endowment rather than deliberate economic policy, these countries will be excluded from the data selection for our study.

The last two decades have seen phenomenal rates of economic growth from China and India. The IMF database shows that the annual rates of growth, averaged over 2003-2012, for China and India were 10.4 percent and 7.8 percent respectively. Even though China and India are the second and ninth economies by size, it must be remembered that they are some of the poorest countries in the world and their high growth rates come from very low bases. Of the 40 largest economies, in terms of wealth as measured by purchasing power parity per capita, India ranks last, behind the Philippines, while China ranks third last, as the following chart shows.

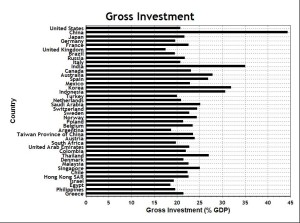

The high economic growths of China and India have come predominately from putting their huge labour force to work at very low wages. These are economies in transition, with employment, wages, investment, etc. not yet stabilized to long-term, sustainable levels. For example, the high levels of gross investment of China and India are outliers among the top 40 economies, as the following chart shows.

In order to study the impact of government on the economy, we select countries where economic and financial constraints on government policy are not affected by special circumstances, such as those mentioned above. Hence the dataset selected from the IMF database is 35 countries from the top 40 largest economies, excluding China, India, Saudi Arabia, Norway and United Arab Emirates. In fact, whether China and India are included or not statistically makes little difference, as will be mentioned below. China particularly is an outlier in many respects and there has often been doubt expressed about the accuracy of its data.

Government Budget Deficit

Contrary to Keynesian expectations, not only is fiscal stimulus through government budget deficits ineffective, as reported by Barro and Redlick (2009), it was found to be counter-productive for the US economy (Sy, 2016b). Fiscal stimulus turned out to be an economic depressant. The explanation lies in what the spending was actually stimulating.

The issuance of US government bonds from budget deficits led to more financial investment and less real investment in economic production, largely as a substitution effect, independent of interest rate policy. The borrowing by the US government was used mainly to finance welfare consumption. Decades of US government budget deficit spending led to ever rising personal consumption, but falling net investment, depressing economic growth (Sy, 2016b).

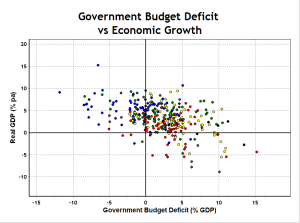

The type of statistical relationship between government budget deficits and economic growth rates found for the US economy over decades is also found across the 35 countries over a ten-year period, as the following chart shows.

A linear regression analysis of the data shows a statistically significant anti-correlation of -44 percent, with an R-square of 0.19, suggesting that one percent increase in government budget deficit will likely cause a decline of -0.36 percent in annual economic growth. (Including China and India would reduce the anti-correlation to -35 percent and the R-square to 0.13 for the regression.) Even though there could be different reasons for this causality for each country, the empirical relationship is unlikely to be a statistical artefact because of the underlying causes identified for the US economy. We conjecture that, through various means (not specified), various government budget deficits lead ultimately to increased consumption, reducing net investment and hence economic growth, in accordance with the axiom of macroeconomics (Sy, 2016b).

Budget deficits are automatically destabilizing, in the sense that any unexpected economic contraction would automatically increase the budget deficits relative to GDP, which then exert a greater depressive effect on economic growth. Indeed, we have identified government budget deficits as the gravitational force of Keynesian black holes (Sy, 2016b), because budget deficits tend to increase, just like the increasing force of gravitation near a black hole. Persistent government budget deficits have created, around the world, mountains of government debt, which could be the fuel for a global financial supernova.

Government Revenue

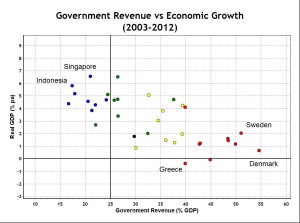

If government budget deficits are to be avoided then the size of government is determined practically by how much tax revenue the government can collect. The following chart shows the statistical relationship between average government revenue and economic growth rates.

The significance of the 25 percent of GDP vertical line in the above chart comes from the observation, from the second chart from the top, that government expenditure above 25 percent of GDP implies a high probability of running government budget deficits. Therefore, if government deficits are to be avoided, then the size of government and government revenue should be limited normally to no more than 25 percent of GDP.

A linear regression analysis of the 35 data points shows a significant anti-correlation of -71 percent, with an R-square of 50 percent. (Including China and India would reduce the anti-correlation to -70 percent and the R-square to 49 percent for the regression.) Clearly, economic growth is also affected adversely by government budget deficits, but one may expect higher government revenues would be compensated by lower government budget deficits. For example, Denmark and Sweden both run small government budget surpluses, indicating that their large-size governments are totally financed by tax revenues. However, these are exceptional cases because the empirical data (examined but not shown here) do not indicate any statistically significant relationship across countries between government revenues and government budget deficits.

It could be assumed that, in democracies, how much revenue a government can collect is a reflection of the collective preference of its citizens. That is, even though a government may prefer more revenue than less, attempts to collect more revenue than the citizens are willing to give may lead only to tax avoidance and tax minimization, as documents leaked from Mossack Fonseca have recently revealed. In this regard, the large sizes of the governments of Denmark and Sweden may be interpreted as reflecting a socialist preference of its citizens.

These countries may be prepared to pay the price of low economic growth, because they have already reached sufficiently high standards of living and have population growth rates well below one percent per annum. Any economic growth rate above 0.5 percent and one percent per annum for Denmark and Sweden respectively would mean still rising standards of living. The large governments of Denmark and Sweden may be considered overt choices of its citizens, as their government expenditures are fully financed by tax revenues, and not by budget deficits.

Large governments financed by budget deficits are covert, because they do not have immediate impact on their citizens’ income. Nevertheless, disapproval of excessive government spending in this case can be expressed, in principle, by their citizens not buying the government bonds issued as a result of the budget deficits. Boycotting government bond purchases may have the effect of driving up government bond yields, making government budget deficits more difficult to finance.

However, in a fiat currency system, government expansion financed through budget deficits cannot be curbed anymore by citizens driving up government bond yields, because governments have virtually unlimited power to monetize their own debt through “quantitative easing”. Through central banks purchasing unwanted bond issuance, governments can even force down long-term interest rates, defying fundamental economic logic by driving up simultaneously both prices and quantities. This market manipulation also reduces debt servicing costs on government borrowings, enabling the scheme to continue unchecked for a long time.

Hence in a fiat currency system, with budget deficit spending, the size of government may not be any longer controlled democratically by its citizens. Governments can expand at will so long as they can escape discipline from financial markets, which are controlled collusively by the big banks and central banks. Therefore, budget deficit spending and government debt have another dimension which differs from financing with taxation, making Ricadian Equivalence clearly false in a fiat currency system. The classical and neoclassical discussions of Ricardian Equivalence are now less relevant because they assume money (e.g. under a gold standard) is not perfectly elastic, in contrast to perfectly elastic money in a fiat currency system.

Socialist Expansion

Socialism and big governments come at a price of a lower economic growth, as a previous post has shown. For the 35 selected countries, average data for the ten-year (2003-2012) lead to the following statistical relationship:

Real GDP (% pa) = 7.49 - 0.124 Total Expenditure (% GDP) (1) (11.7) (-6.81)

The t-values of the coefficients of regression are the figures in brackets below the equation. The relationship is statistically significant with R-square at 58.4 percent and the anti-correlation -76.4 percent, showing that a ten percent increase in the size of government leads to a decline in economic growth by -1.24 percent averaged over the 35 countries.

Given the simple accounting relation for the government,

Total Expenditure = Budget Deficit + Revenue, (2)

socialism expansion can occur through increasing the budget deficit or increasing taxation or increasing both. A multiple regression on the two independent variables using the 35 data points shows a statistically significant relationship with an R-square of 59.5 percent:

Real GDP (% pa) = 7.33 - 0.182 Budget Deficit (% GDP) - 0.115 Revenue (% GDP) (3) (10.5) (-2.72) (-5.67)

The t-values of the coefficients of regression are in brackets below the equation. Both budget deficits and taxation are depressants to economic growth. Statistically, government budget deficits have a greater depressive effect on economic growth than taxation, but the growth anti-correlation with tax revenue at -70.7 percent is stronger than with budget deficit at -43.3 percent. At fixed government expenditure, equations (2) and (3) indicate that increasing taxation (and reducing budget deficits) could have the paradoxical effect of stimulating economic growth, because greater budget deficits does more harm than greater taxation in financing increased government spending.

One may introduce the concept of politically legitimate socialism here. Socialist expansion through overt increase in tax revenue, as Denmark and Sweden have done, may be considered politically legitimate, while covert expansion through budget deficits, as many other countries have done, may be considered politically illegitimate because of issues of transparency, accountability and control. Government expansion through budget deficit spending and creeping socialism may be unstoppable in a fiat currency system, because there are effectively no opposing forces to check the expansion until perhaps ultimately a collapse of the financial system.

Government budget deficits and increased public debt have forced citizens to save more by investing in government bonds which have been channeled to finance welfare consumption. This is a clear case where saving does not lead to real investment, as economically, "saving equals investment" is a textbook fallacy (Sy, 2014c). Governments have increased indebtedness to their citizens. Not all governments, but most, have done this in recent decades in a misguided belief in Keynesian stimulus. The policy has failed because private saving has been diverted ultimately to increasing personal consumption, but reducing real creative investment needed to generate economic growth.

Why Capitalism?

Capitalism is essential because only capitalism can create and distribute real wealth. Socialism, through the government, only creates and distributes claims on wealth. Economic growth is needed for real wealth creation and capital accumulation. Since socialism does not create wealth, but only claims on wealth, it leads to more claims on the same or dwindling amounts of wealth. Hence the economically logical conclusion of complete socialism is stagflation, economic stagnation or collapse, as illustrated by the economies of the former Soviet Union and Maoist China.

To understand why capitalism is essential, it is necessary to understand wealth and how it is created. A wealthy person is manifested by the possession of an abundance of goods and services which defines high standards of living. Today, these possessions include a quality dwelling, motor vehicles and modern appliances such as refrigerator, washing machine, microwave oven, personal computer, flat-screen television, mobile phone, etc.

These modern possessions and everything original have to be created or invented by individuals. For example, no government bureaucrat would ever dream or decide that personal computers are desirable and organize to have them invented. Creativity can only come from the individual, as Einstein (1950) said:

Everything that is really great and inspiring is created by the individual who can labour in freedom.

True creativity, innovation, invention, and ultimately economic growth and wealth, must come from individuals whose successes are often accidental, random and uncertain; they cannot be planned or managed. For example, major scientific breakthroughs cannot be planned because they are surprises and are naturally disruptive; no governments or business bureaucrats would plan to be disrupted from their schedules or from their hold on power.

With each new successful invention, a new and uncertain demand drives new economic growth and creates a new source of wealth. Examples include railroads, electricity, aeroplanes, motor cars, radio, etc. – all have driven unplanned economic growth at their inception. As production increases and prices fall, the new source of wealth is distributed to more and more people, until demand begins to saturate and the contribution to economic growth begins to wane. Hence continual creativity is the source and engine of economic growth. Deflation (falling prices) is a mechanism of wealth distribution to benefit all, because eventually everyone can enjoy previously unaffordable innovations such as home appliances and personal computers.

The Austrian argument (Hayek, 1944) against central planning is based on the impossibility of calculus due to the huge number of variables and parameters involved for an economy. Even if there were a computer big enough and powerful enough to do the necessary calculations, central planning would still fail because the source of wealth creation and prosperity is unpredictable, random and unplannable.

It is true uncertainty (Knight, 1921) which makes entrepreneurs indispensable for wealth creation. The essence of capitalism can be summarized by the following assumption about wealth creation.

Axiom of wealth: New wealth is created by supplying successfully to new and uncertain demand.

The corollary to this axiom is that demand management cannot create new wealth, because planners can manage only known demands. Also, new supply may not succeed in creating new demand, in contradiction to Says Law, because the process of wealth creation is a disequilibrium process with unpredictable results. For this reason, one should not assume that a creative economy can be forecastable or in equilibrium.

The existence of many innovations and modern conveniences, such as automobiles, commercial airlines, etc., would have increased management problems for the central planners who probably prefer that they did not exist to spoil their plans. The entrepreneurial state (Mazzucato, 2013) is an oxymoron because true entrepreneurs must accept a high probability of failure due to Knightian uncertainty for which the state cannot plan.

The priorities of the manager and the central planner are antithetical to progress and to new creations which are inherently disruptive. For the same reason, government investments which are based largely on extracting scale efficiency in meeting known old demands are qualitatively different from private investments based on creating uncertain new demands. Creativity “rocks the boat”, which every public servant has been told to avoid.

Central planning by big government and big business leads to economic morbidity. Big business is antagonistic to capitalism because its goal is solely to maximize profit which can only be stably extracted from monopoly rent. Creativity and innovation challenge monopoly. Competition drives down profits and new products may displace old products and threaten the demand for existing monopoly products of big business.

Macroeconomic data suggest that the managerialism of big government and big business has destroyed much of the creativity of Western capitalism in the past several decades. Instead of allowing the creative destruction of the obsolete under capitalism, which gives rise to new and vigorous economic growth, there has been creativity destruction of new ideas under socialism, which conserves old and inefficient businesses and achieves moribund economic growth. Capitalism is progressive, disruptive and vibrant; socialism is conservative, stable and moribund.

Writing in the years around the Second World War, both Keynes and Schumpeter were unduly influenced by the Great Depression and the early successes of the former Soviet Union. For example, Schumpeter (1943) stated explicitly: “Can capitalism survive? No. I don’t think it can…Can socialism work? Of course it can.” It is ironic that Schumpeter did not fully appreciate the significance of his own idea of “creative destruction” in capitalism and did not connect it with wealth creation, as we have suggested in this post.

Economists, including great ones of the past, have expressed a full spectrum of opinions, but mostly unsubstantiated by facts. Certainly, there have been many who have argued lengthily and philosophically about the right size of government. But the empirical evidence presented in this paper is new and the reasoning is precise and different, and more importantly, it is contextualized in space and time and relevant to contemporary institutions without pretence to universality.

To summarize, management of aggregate demand cannot create wealth, because new wealth comes from creating and supplying new and previously unknown demand and hence new wealth creation cannot be planned or managed. New wealth creation is uncertain and unpredictable but it is the source of prosperity.

Conclusion

Contrary to the Keynesian fallacy, it has been shown from data that government spending reduces economic growth, because more government spending means less capitalism and less wealth creation.

How much capitalism versus socialism should be a collective decision made by informed citizens in a democracy. But the attack on capitalism (Hussey, 2014) in the aftermath of the global financial crisis (GFC) shows a generally ill-informed public, lobotomized by an economic education (Chakrabortty, 2014) which is biased to socialism poorly understood and staunchly defended by university academics, dependents of the state.

Nevertheless, socialist expansion by increased government expenditure through raising tax revenues is sufficiently overt to suggest that the level of socialism may be a deliberate choice of the citizens of some countries such as Denmark and Sweden. The sizes of government in these countries are about half the size of their economies, leading to low economic growths – which may be acceptable to countries with low population growths.

However, socialist expansion by increased government expenditure through budget deficits is covert, with many economists welcoming government debt as a means to increase private saving, with Krugman (2015c) declaring “Debt is good”. Empirical evidence presented above for 35 countries and for the US economy presented elsewhere (Sy, 2016b), shows that budget deficits are self-defeating because they cause economic instability and reduce economic growth.

Yet the running of persistent government budget deficits has been the norm in many countries, creating mountains of debt which governments have been dealing with by manipulating interest rates, stimulating inflation and monetizing the debt through printing money. All such interventions have unintended consequences of causing more misallocation of capital and waste of economic resources, further depressing economic growth.

It is ironic that some economists (Bernanke, 2004) believe that "improved performance of macroeconomic policies, particularly monetary policy" had banished the business cycle in a period of low volatility called the Great Moderation of the 1990s. Nothing can be further from the truth. During that decade, US government expenditure was reduced from 34 percent of GDP to less than 29 percent, the lowest level since the 1960s, with the US government budget moving into surplus. Official US interest rates were raised from three percent to six percent and held there for several years. The Great Moderation was associated with less government intervention and less government stimulus.

If a government were to kick the Keynesian addiction to stimulus and avoid the Keynesian black hole (Sy, 2016b), it would have to balance its budget, which is a fiscally responsible action otherwise known as “austerity”. The empirical data suggest that for a balanced budget, the size of government should be less than 25 percent of GDP, which represents apparently an upper limit to the tax revenue collectible by most countries. Hence, unless citizens are willing to pay more tax, the implied level of capitalism should be at least 75 percent of GDP.

Note that the minimum level of capitalism at 75 percent is determined empirically, not based on any complicated or lengthy argument, as other economists may have offered. This level may change as circumstances and data change in another economic era, when institutions and economic knowledge may be different from now. But, for now, the greater the level of desired economic growth, the greater the level of capitalism is required.

With few exceptions, too many governments around the world have been too big for too long. Managers need to step aside after the mess they have made to public policy – in education, economics, and many other areas. Capitalism needs to be given a chance.