The great inventive minds of modern economics (GIMME) have been busy talking about helicopter money as an option they could try in future as another unconventional monetary policy (UMP) to avoid “deflation” or “lowflation” (Lagarde, 2013). Actually, helicopter money is a very old idea and already has been in operation for several years. But nobody, not even some prominent critics of central banks, seems to have recognized it yet. What is helicopter money? What is it for? Has it worked? Will it work?

To answer these questions, it is necessary to review briefly what has happened so far and why the idea of helicopter money is being resuscitated. Since the global financial crisis (GFC), all sorts of extreme policy measures – including zero interest rate policy (ZIRP), negative interest rate policy (NIRP), quantitative easing (QE), fiscal stimulus packages, etc. – have been deployed to try to revive global economic growth. To implement these extreme measures, many trillion units of major currencies have been created by printing money.

Printing money is defined as fiat currency (legal tender or its electronic equivalent as high power money or base money) creation (“out of thin air”) by an authority (with coercive powers) such as a government or a central bank for whatever purpose. Mostly, recent money printing has been for the purpose of conducting QE. Quantitative easing is defined as the central bank printing money to buy private or public securities from private sector investors through its “primary dealing” investment banks. The aims of quantitative easing are to raise prices and lower yields of long-term debt (twisting the yield curve clockwise), to take non-performing loans off the balance sheets of insolvent banks and to inject cash into the economy, ultimately stimulating consumer spending.

While ZIRP, NIRP, QE and fiscal stimulus have created a flood of liquidity and a mountain of debt, they have not revived global economic growth, with the recovery from the Great Recession being one of the weakest on historical record. The result has not been commensurate with the fire-power of the policy stimulus deployed. GIMME want more of the same – more money and debt – but are running into some constraints such as zero lower bound (ZLB) in official interest rates to stimulate more credit creation, as Summers (2011) has said on several occasions:

…the central irony of financial crises is that they’re caused by too much borrowing, too much confidence and too much spending and they’re solved by more confidence, more borrowing and more spending.

The mountains of debt everywhere have grown so large at near zero interest rates that restoring to more normal interest rates (normalization) would be very difficult if not impossible because higher rates would create enormous debt service costs for the debtors. The Keynesian GIMME stimulators have to find new ways of stimulating without adding to the mountains of debt in order to avoid the fear that future debt servicing costs could hamper more future government spending.

Helicopter Ben

The new idea to avoid increasing government debt, which is actually centuries old, is simply to create helicopter money. The idea is to create spending money (“out of thin air”) and freely distribute it to consumers without at the same time creating government debt or future debt servicing obligations. This idea of printing money and spending it without future obligations is as old as paper money itself. Helicopter money only sounds new because flying helicopters around has been possible for less than one hundred years. In his economic theorizing, Milton Friedman (1969) considered the following thought experiment:

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.

Friedman went on to draw different conclusions depending on different assumptions about consumer behaviour. Helicopter money also called “QE for the people” was recently proposed to distribute “free money” to people, so that they could spend and stimulate economic growth. The assumption is that economic growth has been weak due to insufficient consumer spending because the “free money” of QE was given to the banks, which hoarded the money, instead of the QE money being given to consumers for spending.

As mentioned above, helicopter money as printing money and spending it, is a very old idea. Under the Mongol government of the Yuan dynasty (1279-1367), paper money became the only legal tender. There were subsequently also other periods of fiat currency in China. In Europe and America, there were the “Assignats” during the French Revolution until 1803, the German Reichsmark in the Weimar Republic in 1920s, and the Continental dollar in the American Revolution, and there were other fiat currencies in many other countries at different times. All past fiat currencies were abandoned eventually due to hyperinflation caused by helicopter money.

Using very sophisticated assumptions and mathematics, Buiter (2014) proved that helicopter money will always be spent, increasing aggregate demand and causing inflation (as history has proved); he concluded therefore that deflation can always be avoided with a helicopter drop. As the Chairman of the Financial Services Authority (FSA) of Britain, Turner (2013) also endorsed helicopter money “because there can be extreme circumstances in which it is appropriate policy”.

In 2002, in a speech titled: Deflation: Make sure “it” doesn’t happen here, Ben Bernanke, then a new member of the Board of Governors of the US Federal Reserve, suggested an implementation of helicopter money through tax cuts:

A money-financed tax cut is essentially equivalent to Milton Friedman's famous "helicopter drop" of money.

Bernanke anticipated that, should easing official interest rates become impossible, helicopter money is still available to combat deflation and he concluded his speech saying:

…the Federal Reserve and other economic policymakers would be far from helpless in the face of deflation; even should the federal funds rate hit its zero bound.

In a recent blog giving an expanded expose, Helicopter Ben (Bernanke, 2016) gave a formal description of a “helicopter drop” as a Money-Financed Fiscal Program (MFFP). Essentially, he described the process as the Federal Reserve printing money (or crediting a government account at the Federal Reserve) which is then available to finance government spending. This process is tantamount to the government itself printing money and spending it. But Helicopter Ben denied that the US government is already doing this when he concluded:

Money-financed fiscal programs (MFFPs), known colloquially as helicopter drops, are very unlikely to be needed in the United States in the foreseeable future.

This statement can be shown to be false. One of the purposes of this post is to show that helicopter money is already in operation in the United States and elsewhere through the monetization of government debt. The reason why it has not been recognized generally is due to operational manoeuvres which confuse economists and the public.

Operational Constraint

As mentioned above, the history of fiat currency systems shows that, without procedural constraints or physical constraints such as a gold standard, a fiat currency system invariably collapses from hyperinflation. Self-imposed operational constraints have been created to slow the rate of money printing to control unfettered inflation and to stabilize the monetary system.

If a government can both create money and spend it too easily and too quickly, spending could be excessive and there would be little political incentive to keep track of how much money has been created and spent. The ability to print money freely means there would be no debt to restrain spending because the government does not need to borrow – the public debt problem is solved! Now the government can give money to anyone who needs it or wants it. Modern Money Theory (MMT) is founded (Fullwiler et al., 2012) on the insight that a sovereign nation which can print its own money is not financially constrained – hence government debt, taxes or budget deficits no longer matter.

But as history has shown, financially unconstrained governments have always led their nations to financial and economic chaos. For this reason, operational procedures have been developed in many countries to constrain the level of government spending financed through printing money. Independent central banks have been created to separate the function of money creation from the money spending function of governments. This is a self-imposed constraint (discussed further below) which many have forgotten or do not understand. For example, Fullwiler et al.(2012) assert that money is created automatically through government spending and that the role of the central bank is “unnatural”, stating:

Clearly this self-imposed constraint is anything but “natural” and cannot be useful for describing a general case for government debt operations.

In MMT finance, the government is regarded as a consolidation into a single entity of the treasury and the central bank, making the idea of an independent central bank irrelevant. Indeed, if there were no central bank and the government treasury can freely create and spend money, then helicopter money would easily be accomplished since the treasury can

- Create spending money without incurring debt servicing obligations;

- Distribute the money to the general population for consumer spending.

Contemporary discussion on helicopter money revolves mostly around how helicopter money or MFFP could be implemented – i.e., how to develop ways to get around the discipline imposed by the separation of government spending and the central bank printing money. The financial discipline is essentially the self-imposed operational constraint forbidding the direct monetization of government debt.

For example, the US Federal Reserve is forbidden to buy Treasury securities directly from the U.S. Treasury, in regular Treasury auctions, as is explained by the Federal Reserve Board:

The Federal Reserve Act specifies that the Federal Reserve may buy and sell Treasury securities only in the "open market." The Federal Reserve meets this statutory requirement by conducting its purchases and sales of securities chiefly through transactions with a group of major financial firms--so-called primary dealers--that have an established trading relationship with the Federal Reserve Bank of New York (FRBNY).

Article 123 of The Treaty on the Functioning of the European Union (2012) states similar prohibitions:

Overdraft facilities or any other type of credit facility with the European Central Bank or with the central banks of the Member States…shall be prohibited, as shall the purchase directly from them by the European Central Bank or national central banks of debt instruments.

These prohibitions prevent money financing or direct financing of government spending with printed money. And since the central bank can print money, but cannot spend it, a helicopter drop is not a tool of unconventional monetary policy (UMP) available to the central bank. The central bank can create the money but it has neither the mandate nor the means to distribute the money to the general population. Only the government with its tax office and its social security department can send money to taxpayers and social welfare recipients.

Under established operational constraint, helicopter money requires formal cooperation between the government treasury and the central bank, raising the question about the meaning of an independent central bank, which was created in the first place to exercise independent judgement to prevent reckless government spending.

Was the secret meeting between Obama and Yellen on 11 April 2016 an emergency meeting of cooperation? Did the meeting presage more helicopter money or a preparation to protect the US Treasury market from foreigners dumping US treasuries? Any foreign country, Saudi Arabia, Russia or China, selling large quantities of US treasuries would be met with the US Federal Reserve intervening to monetize the debt.

The public impression is that something new and extra is needed to implement helicopter money, as Buiter (2014) stated:

Cooperation and coordination between the Central Bank and the Treasury is required for the real-world implementation of helicopter money drops.

Bernanke (2016) also agrees, expressing the opinion on helicopter drops:

They also present a number of practical challenges of implementation, including integrating them into operational monetary frameworks and assuring appropriate governance and coordination between the legislature and the central bank.

This view, that something new is needed, is not really true, because the self-imposed operational constraint has not really prevented helicopter money which has been created through indirect government debt monetization for several years in many countries.

Government Debt Monetization

From the definition above, QE is defined as the central bank printing money to buy private or public debt securities, a procedure also known as debt monetization. While QE injects base money as liquidity into the economy and substantially expands the balance sheet of the central bank with debt securities, the intention always has been to retract the liquidity later by selling those securities back into a stronger economy, particularly through repurchase agreements (Repos). But several years after the initial QE in 2009, central bank balance sheets remain distended and growing.

Should the government debt sit permanently on the central bank’s balance sheet, then it is de facto MFFP or helicopter money because government spending has been financed by printing money. To see that government debt monetized by the central bank involves no debt servicing cost to the government, one only needs to note that the central bank can simply remit all coupon payments from government debt it owns, back to the treasury as operating profit of the central bank, claiming that QE actually makes profits for the government.

For all practical purposes, though not technically, the US Federal Reserve (the Fed) is part of the US Government; the government debt on the Fed’s balance sheet is the US government owning its own debt. The Fed can be seen as a government agency, with independent powers, monitoring and facilitating government finances. Another government agency also monitoring US government finances is the Government Audit Office (GAO).

Another way to see that the central bank’s government debt is helicopter money is to note that in theory, if not in practice, the US Federal Reserve can cancel or write-down to zero the US Treasury securities it has purchased. It would be a “debt jubilee” of the government to itself. But such a “debt jubilee” is not necessary because, as noted above, the government debt sitting on the balance sheet of the US Federal Reserve can be held to maturity and has no ongoing financial consequence because it creates no real debt service burden for the US government. A “debt jubilee” would make it obvious that the US government is printing money purely and simply.

As at 28 April 2016, the US Federal Reserve has total assets of $4.44 trillion, comprising $2.46 trillion in US treasuries, $1.75 trillion in mortgage backed securities and only $230 billion in currencies and other assets. There were no repurchase agreements. We assert that the $2.46 trillion in US treasuries should be considered as helicopter money because

- The US federal Reserve has been printing money, buying US Treasury securities indirectly and holding them as assets on its balance sheet (about $2.46 trillion);

- The money has been used to finance budget deficit spending on tax cuts and social welfare consumption (several hundred billion dollars per year or several percent of GDP).

Government debt held by the private sector or other parts of government, such as public pension and social security funds, involves inescapable debt servicing obligations, while government debt held by the central bank involves no real debt servicing cost to the government. This is the critical difference between “money-financed” government spending and “debt-financed” government spending. Hence government spending financed by monetization of government debt is equivalent to “money-financed” government spending which is helicopter money.

Open Market Operation

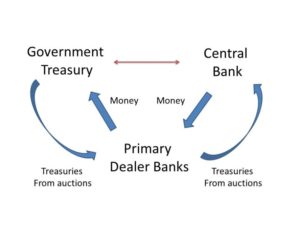

The fact that the US Federal Reserve cannot participate directly in US Treasury auctions means that the central bank cannot monetize government debt directly, having to purchase them from the primary dealers in open market operations (OMO). But this restriction represents no real operational impediment, because the primary dealers can be seen as brokers to the transaction, as the following chart illustrates. The central bank can order the primary dealers to purchase securities from US Treasury auctions, and then purchase them from the primary dealers in much the same way as investors trade securities through market makers. Of course, there is normally no reason or need for an independent central bank to buy government debt in this way, because government securities are normally fully subscribed by the private sector through the primary dealers.

The central bank can order the primary dealers to purchase securities from US Treasury auctions, and then purchase them from the primary dealers in much the same way as investors trade securities through market makers. Of course, there is normally no reason or need for an independent central bank to buy government debt in this way, because government securities are normally fully subscribed by the private sector through the primary dealers.

But the primary dealer banks play a special role in the scheme of OMO. If the public has no appetite for the treasuries on auction because they are over-priced with low yields but a large supply, then the central bank may be required to step in and underwrite the money-finance of government’s deficit spending. In this way, helicopter money has been created in abundance in many countries in the past several years. Instead of higher long-term interest rates on government bonds rising from market discipline, they have been forced lower by helicopter money, creating historical credit bubbles of epic proportions. Negative interest rates are created artificially by inflating the prices of government debt through monetization.

The “prohibition on money financing” of government spending is an important part of the fiscal discipline required particularly by the European Central Bank because of the economic structure of the European Union. But in some countries like Japan, the central bank is expected to provide “money financing” according to government decisions. The Bank of Japan can transact directly with the government. Article 34 (iii) of the Bank of Japan Act states that one of the functions of its central bank is:

Subscribing or underwriting national government securities within the limit decided by the Diet as prescribed in the proviso of Article 5 of the Fiscal Act.

This means that the Japanese government decides how much money it requires its central bank to print to finance its spending needs. With the direct monetization of government debt, helicopter money is already operating overtly in Japan. In April 2015, the Bank of Japan has about ¥300 trillion of Japanese government bonds (JGB) with total assets of ¥366 trillion. Since Japanese GDP is about ¥500 trillion, the level of government debt monetization in Japan is about 60 percent of GDP. The amount of outstanding JGB is about ¥1,040 trillion with the Bank of Japan holds about 30 percent of outstanding JGB, while foreigners hold just under 10 percent. Japan leads the developed world in the creation of helicopter money, but it has also the most moribund economy.

Does Helicopter Money Work?

The fact that global economic growth is weak and there is still a fear of “deflation” suggests that the helicopter money created so far has had, at best, little positive impact. But the standard refrain from the GIMME advisors is that it has worked, but there needs to be more of it. But the ultimate result of more helicopter money has already been predicted by history – eventual collapse from hyperinflation. Venezuela, a country with the highest oil reserve (nearly 300 billion barrels) in the world in 2015, is collapsing with over 200 percent annual inflation and an economy contracting at more than seven percent in 2016 – showing that printing money causes inflation, but inflation does not lead to economic growth.

It is mind boggling to imagine that anyone could believe that economic problems can be solved simply by creating inflation through printing money and government spending. The reason why helicopter money has failed, will fail, and eventually will lead to disaster is that it increases consumption but decreases economic production. Increasing consumption is easy to understand, but decreasing economic growth from failing to stimulate production is virtually impossible for brain-washed Keynesians to understand.

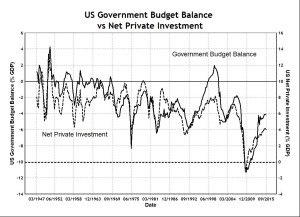

In the US, private consumption has been boosted by social welfare consumption financed through transfer payments from government budget deficits. The government bonds issued attract private sector investment which is diverted away from real investment in economic production, reducing employment and economic growth. The following chart shows (Sy, 2016) that US government budget deficits caused nearly a dollar-for-dollar decline in private sector investment in the last few decades.

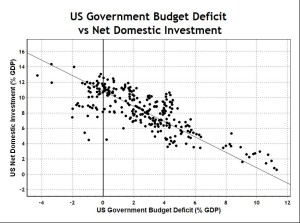

The fall in real private investment caused by government budget deficits leads to a fall in net domestic investment as the following chart shows a statistically significant relationship, where regression analysis shows an anti-correlation of -82.3 percent, with an R-Square of 67.7 percent.

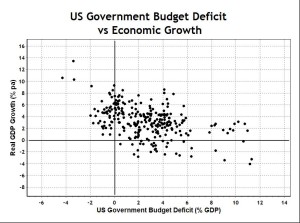

Falling net domestic investment due to government budget deficits has led to a secular decline in US economic growth (Sy, 2016). The statistical evidence is shown in the chart below.

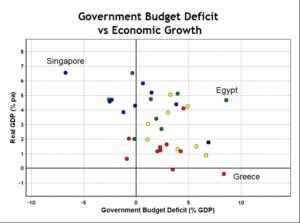

The negative impact of government budget deficits on economic growth is seen not only for the United States, but also for most other countries. Averaged on a ten-year period (2003-2012), International Monetary Fund (IMF) data show the following statistical relationship for 35 countries.

At the risk of over simplification, we conclude that government budget deficit spending and helicopter money will not work because they increase consumption and inflation, without increasing economic production. It is an enduring Keynesian fallacy that stimulating consumer demand leads to higher economic growth. In fact, government budget deficit spending is the gravitational force sucking the economy into a Keynesian black hole (Sy, 2016).

It is true that the free money of the GIMME “cargo cult” will most likely be spent like any other money distributed from social welfare. But it will cause stagflation due to more money chasing the same quantity of goods and services, with lower economic growth due to more resources being diverted to consumption rather than to investment.

Helicopter money is money printing for general distribution. Money printing is not wealth creation but wealth expropriation by the money printer. Wealth is taken from those who produce and given to those who do not. If everyone can consume without work, why work? Socialist measures such as helicopter money redistribute wealth and income, increase consumption, but decrease economic growth. Helicopter money therefore cannot bring economic revival.

Conclusion

Economic policy generally has never been based on scientific theories supported by strong empirical evidence, because economics is not science. Instead, policy has been based on political beliefs supported by arguments, sometimes expressed through sophisticated mathematical models disguised as science. In reality, economic policies have been real-time experiments with random results.

The modus operandi of this process has been well summarized (Charlemagne, 2002) by Jean-Claude Juncker, the President of the European Commission, when he remarked on how the creation of the European Union was made possible:

We decide on something, leave it lying around, and wait and see what happens. If no one kicks up a fuss, because most people don't understand what has been decided, we continue step by step until there is no turning back.

Helicopter money is an idea which has been lying around for a while and, since “no one has kicked up a fuss”, it has been tried already as an early step through the indirect monetization of government debt – which “most people don’t understand… has been decided” and implemented.

From the GIMME point of view, helicopter money has been field tested already and declared a success, for otherwise “things would have been worse”; the claim is that a Greater Depression has been averted. The chief of the IMF, Christine Lagarde (2013), declared that unconventional monetary policies (UMP) have been a clear success saying “today’s calculus of UMP benefits is still clearly positive for UMP countries”.

It appears that soon more steps may be taken. The next step may be to cancel the government securities on the central bank’s balance sheet to leave no doubt in the minds of consumers that the printed money will not be withdrawn in future – so that the printed money is then seen as a “permanent and irredeemable” increase in the money supply (or permanent QE) to induce more consumer spending and to create consumer price inflation.

If helicopter money is accepted openly as legitimate policy, as many high-profile Wall Street investment managers (Gross, Icahn, Gundlach, etc.) have already agreed, then the money printers will be cranked up “until there is no turning back”. Someone has to kick up a fuss about this madness before it’s too late.

This post has pointed out that "Japan leads the developed world in the creation of helicopter money". The Bank of Japan has already monetized 300 trillion Yen of Japanese Government Bonds or 60 percent of GDP. This debt has no net financial impact and causes no constraint on government finances. Helicopter Ben Bernanke does not need to teach Japan how to print money:

http://www.zerohedge.com/news/2016-07-11/something-big-indeed-came-bernankes-japan-visit-sparks-monster-rally-after-helicopte

If governments and central banks can print unlimited money, then they can push the price of anything that money can buy to any high value they like. Vast amounts of helicopter money have already gone to create bond prices of unrealistic values with negative interest rates. Some stock prices are at historical highs.

Financial markets are so manipulated and distorted that they no longer have any connection with economic fundamentals. Apart from professional investors who gamble with other people's money, most other investors are desserting the phoney markets. The wealth effect, if it ever existed, is surely becoming irrelevant.

Governments and central banks are effectively owning more and more of all financial assets. With unlimited fiat currency, they can potentially own all financial assets. Financial asset prices may have no limits. However, fiat money and financial assets are not real capital and their normal relationships with real capital have been destroyed.

Financial markets are therefore less and less relevant to real capital formation which fuels production and economic growth. Monetary policy is destroying the real economy until all real wealth has been consumed and the economy collapses into the Keynesian black hole.

Politicians are so clueless about economics that they look for new ideas and inspiration from academics who live in their own imaginary worlds divorced from reality. Helicopter money sounds new only because academics have been making noises in the media to show that they are the great inventive minds of modern economics (GIMME).

Abenomics having failed to revive the Japanese economy, Shinzo Abe, no doubt, wants to try new ways of flogging the dead horse. He probably suspected incompetence on the part of his own advisors and wanted to hear the "new" idea directly from Helicopter Ben, a leading GIMME advisor.

Surely, to Abe's amazement, Japan is already ahead of the US in the use of helicopter money, as Bloomberg reported:

http://www.bloomberg.com/news/articles/2016-07-14/bernanke-floated-japan-perpetual-bonds-idea-to-abe-adviser-honda

Helicopter money has been in operation in Japan and it hasn't worked, as Bloomberg reported, in the opinion of another GIMME advisor:

So it is only politics talking. Helicopter money is really to make clear to the ignorant masses that central banks have already been printing money, as the government debt on their balance sheets are financially irrelevant, as another GIMME advisor explained:

So the Japanese people should hurry up and trash their own currency. But remember that in agreement with Lenin, Keynes warned:

It appears therefore that there is a deliberate policy which "engages all the hidden forces of economic law on the side of destruction" of capitalism and individual freedom.

Larry Summers and Adair Turner were two high ranking government economists who contributed to policies which caused the global financial crisis (GFC) as the evidence assembled on this blog suggests. (Larry Summers was a deregulator of derivatives and a repealer of the Glass-Steagall Act.) It has never occurred to them that "secular stagnation" or collapsing economic growth is caused by their own meddling. The following video shows their latest ruminations:

https://www.youtube.com/watch?v=sirXAfpIrao

What sort of lobotomized audience would not challenge their theory for why interest rates have been so low? They ignore "the elephant in the room", which is the central banks setting low interest rates. How is their explanation helped by waffle about over-supply, deficient demand, high saving, low investment, blah, blah. How about the politically expedient policy of perpetual monetary stimulus?

Their unscientific theorizing using loose verbal reasoning leads to mostly fallacies and will no doubt provide the rationale for even more government spending, which they assume needs more extraordinary expansion. Their assumption that fiscal spending will "pay for itself" has been contradicted by empirical facts in the past decades. The Obama stimulus package in 2009 was a recent example. Most likely, the greater fiscal spending advice will be welcomed by the Donald Trump presidency. Helicopter money in greater abundance and Keynesian economic collapse seem inevitable at this point.

The best remark of the whole discussion was made when Larry Summers said (49 min), apparently unconscious of the irony,

The irony is: what does the award of "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel" say about economics?

The video also ends with a quote from Larry Summers, cited by Rob Johnson as a reason for optimism (1hr 10min):

If this is optimism, God help us. This practice has been, for too long, a form of ad hoc policy making on the run, untested, unscientific and harmful.

I cannot agree with, and question, the author's conclusion, as postulated here :

"" (As t)here were no repurchase agreements. We assert that the $2.46 trillion in US treasuries should be considered as helicopter money because

- The US federal Reserve has been printing money, buying US Treasury securities indirectly and holding them as assets on its balance sheet (about $2.46 trillion);

- The money has been used to finance budget deficit spending on tax cuts and social welfare consumption (several hundred billion dollars per year or several percent of GDP).

There is no basis for the accompanying assertion that these transactions equate to $2.46 Trillion in 'helicopter money', or overt money financing (Turner) of deficits.

It should be first noted and agreed that there was merely a swap of assets involving these 'US treasuries' , being zero of ' purchasing power' transactions involved. Yes, Fed received the TSYs and GSE "securities (asset) and the banks received CB reserves (asset) as 'consideration' in the swap.

But the Treasury received nothing, which cannot equate with 'helicopter money'.

There was no pathway and no transmission mechanism for these 'interbank-only' reserve funds to ever provide for the funding of ANY government deficits, except in the year they were first issued.

For the record, an issuance of helicopter money, as a matter of public monetary policy, must be defined as adding 'purchasing power' to the monetary economy, as fuel to advance 'demand' in the real economy, something that is not possible, again, with a mere swap involving CB (interbank) reserves.

Thanks.

US treasury bills, bonds and other securities are all issued by the government and the private sector. Normally all government securities are held by the public, except for QE. In QE, the central bank buys securities created by both the private and public sectors by printing money. The central bank does not and cannot create securities in the normal sense; repurchasing agreements being agreements for central bank to rescind printed money by selling back its government securities, as a way of controlling the amount of printed money in circulation.

In QE, there is no asset swap, in the sense of swapping of government securities, e.g. treasury bills for bonds by the central bank (as asserted by Fama). Treasury bills are not created by the central bank; they are issued by the government treasury. The treasury receives money (not nothing) when it sells treasury securities at auctions. This money received by the Treasury usually come from the public via primary dealers.

In QE, instead of the public buying treasuries, the central bank prints money and buys covertly treasury bills and bonds via the primary dealers. The government treasury gets the printed money indirectly from the central bank and this money may be used to finance government spending and fiscal deficits. If the central bank later sells its treasuries back to the public via repurchase agreements with its primary dealers, then it withdraws money from the public which has to pay for those securities. Liquidity and money supply are then influenced by these open market operations (OMO).

When the central bank prints money which ends up at the treasury (via primary dealers) and the government then spends it, it is "money financed" government spending rather than "debt financed" government spending because the interest payments for the treasuries on the central bank's balance sheet involves no real financial burden on the government. This is helicopter money and it adds 'purchasing power' to the government which can be passed onto others.

Helicopter money distributed to welfare recipients (welcomed by academics) obviously increases consumption demand. The size of the central bank's balance sheet is a measure of the money printing which has taken place. Until money is withdrawn from the public which is willing to repurchase the central bank's securities, that money is essentially helicopter money.

In summary, QE is not asset swap. QE is money printing which is measured by the increase in the amount of M0 money base. If the printed money goes to too-big-to-fail banks, then it is bailout. If the money goes to the government to spend on households and businesses, it is helicopter money.