The previous post suggests that the US economy may be in a Keynesian black hole. Many other countries around the world are also likely to be in Keynesian black holes. The danger is that the larger black holes will cannibalize smaller ones, leading to a supernova explosion and an orgy of wars which are being seen around the globe.

An economic black hole is defined as an economy which consumes more than it produces, leading to wealth destruction rather than wealth accumulation as in a normal economy. A Keynesian black hole is a black hole created by the pursuit of Keynesian economic policies. The phase transition to a Keynesian black hole occurs as an economy moves through the Keynesian singularity where the Keynesian multiplier is infinite.

Keynesian economic policies attempt to increase economic growth through increasing the Keynesian multiplier by inducing more and more consumer spending, in an effort to boost aggregate demand. A double barrel bazooka of fiscal and monetary stimulation has succeeded in boosting consumption over time, but the increase in economic growth has not been commensurate with the level of fire power deployed. The policy response has been to do even more of the same, assuming that still more consumption was needed.

Decades of pursuit of Keynesian policy have pushed many economies beyond the Keynesian singularity, with propensities to consume greater than unity, indicating consumption exceeding production. Complete collapse of the Keynesian black holes has been avoided temporarily by the economies devouring the wealth of savers through disguised transfers made possible by government policy and financial innovations.

This post describes the evolutionary path driven by fiscal dynamics which have led the US economy into the Keynesian black hole. This story, told graphically, has started in the previous post and continues here by showing the post-war history of the US macroeconomy using official empirical data – the mathematical theory underpinning the story is detailed in a separate research paper. Before continuing this story, the reader should be assured that this story is new and unique and can only be told after making a truly scientific inquiry.

Obviously, Keynesian economics would never countenance the existence of Keynesian black holes. Marxian economics would never contemplate that a socialist government could lead an economy to collapse. Classical, neoclassical and Austrian economics believe that the government is either irrelevant or only temporarily harmful, causing short-term economic fluctuations, but that individuals are rational enough to neutralize the actions of government and to allow the free-market to prevail in the long-run.

Mainstream neoclassical economics assumes that economic crises are exogenous in a world of rational expectations. Austrian economics assumes that business cycle fluctuations and recessions are caused by the credit cycle induced by government monetary policy. These free-market theories do not bother to include properly the institution of government in explaining economic outcomes and are therefore unable to assess accurately the impact of government. A new approach is required to assess the impact of government.

The impact of the US government has been shown in the previous post to be significant and not neutral in the long-run. Government budget deficits have increased total consumption, at the expense of net domestic investment of the US economy which is discussed further here. The conclusion reached is much stronger and more radical than any which has been advanced to date in macroeconomics. Not only is fiscal stimulus ineffective, as found by Barro and Redlick (2009), it is shown here to be the cause of the secular US economic decline and the gravitational force of the Keynesian black hole.

In the previous post, virtually no theoretical assumption has been made; only facts have been shown from the empirical data. To proceed further on how those observed facts would affect economic outcomes, it is necessary to state explicitly a theoretical assumption suggested by the observed facts.

Impact on Economic Growth

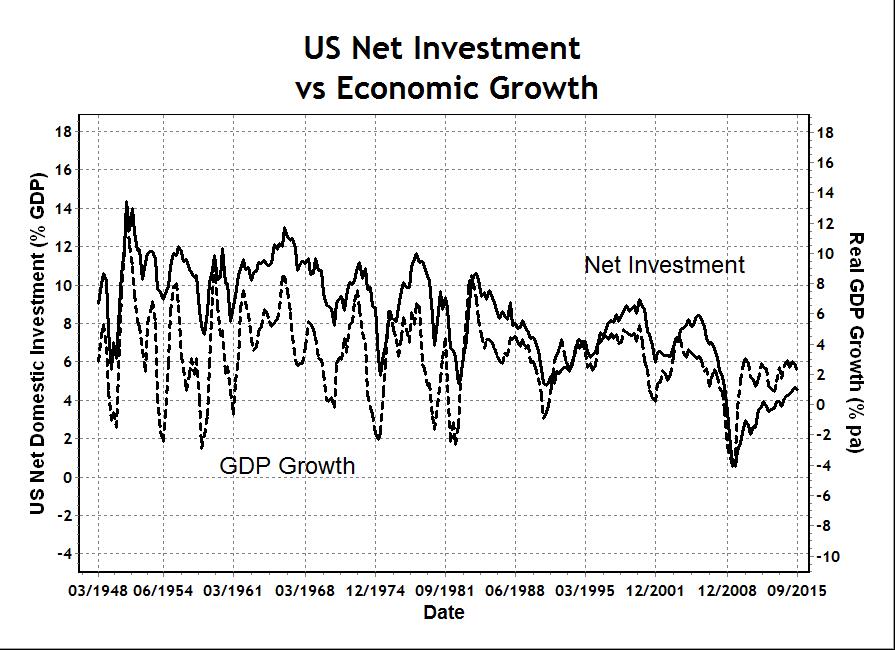

It is an unrecognized Keynesian paradox that, despite ever-increasing consumption, there has been a secular decline in US economic growth with a trend growth in real GDP after WW2 at about four percent per annum declining to two percent now. It is an enduring Keynesian fallacy that greater consumer spending leads to higher economic growth (Sy, 2014.1). In essence, economic stimuli have succeeded in boosting US consumption, but not economic growth. It is the purpose of this post to quantify how, and to what extent, fiscal stimulus has boosted personal consumption, but has depressed economic growth.

Given observed facts about government policy and their effects on private spending, what is their impact on economic growth? It is necessary to hypothesize about what causes an economy to grow, stated here as an explicit axiom:

Axiom of macroeconomics: Economic growth is generated from net investment in the production of goods and services.

This axiom is different from Says Law which states that supply creates its own demand. Or conversely, it is also different from any opposing law (e.g. Keynesian) of demand creating supply because these classical laws are assertions of equilibrium, a notion without good empirical evidence. In a scientific approach, equilibrium cannot be assumed unless supported by evidence. Empirical data suggest that, instead of equilibrium, disequilibrium is observed in nearly all economic variables most of the time. The axiom of macroeconomics is a statement of causality and it is intended to apply equally in all situations of equilibrium or disequilibrium. The empirical evidence supporting the axiom of macroeconomics is shown in the chart below.

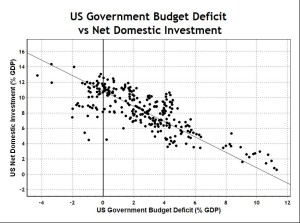

The previous post has found that fiscal stimulus has been successful in increasing total consumption of the US economy and therefore fiscal stimulus, particularly through government budget deficits, has also reduced net domestic investment, as the chart shows below.

The diagonal line is the 45 degree line or the “dollar for dollar” line which shows that US government budget deficits substantially “crowd out” US net domestic investment due to a simple substitution of financial investment for real investment. Note again that this is different from the “crowding out” effect in textbooks (e.g. Mankiw, 2009, pp.791-792) which refers to the impact through interest rates on aggregate demand, with no particular emphasis on investment. A regression analysis shows an anti-correlation of -0.82, a slope coefficient of -0.80 and an R-square of 0.68.

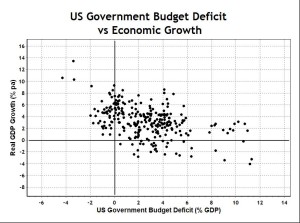

Through the axiom of macroeconomics, the consequence of budget deficits, in increasing consumption but decreasing investment, is that budget deficits have been depressing economic growth as the chart shows below.

Increasing budget deficits (to the right of the chart) are associated with lower economic growth while higher budget surpluses (to the left of the chart) are associated with higher economic growth. The data suggest that recessions are only associated with budget deficits, seen as data points in the lower right quadrant.

A linear regression analysis shows an anti-correlation of -0.46, statistically significant with R-square of 0.21. On average, a one percent (of GDP) increase in US government budget deficit depresses US GDP growth rate by about 0.45 percent. The current level of budget deficit at about 4 percent of GDP would be depressing US GDP growth rate by about 1.8 percent per annum, compared to a balanced budget. Instead of the currently measured growth rate of about two percent, a balanced budget would be delivering a doubled growth rate of about four percent.

Impact of Fiscal Stimulus

One may argue that economic slumps cause the government to attempt to rescue with fiscal stimulus, which results in larger budget deficits. While this reflexive reaction on the part of government is apparently undeniable, the resulting fiscal stimulus has failed to bring about stronger growth as desired. This failure to stimulate growth, in turn, caused more fiscal stimulus to be applied leading to a vicious circle of greater stimulus and further economic decline, leading to the trend of secular decline seen in the above charts.

In January 2016, the Congressional Budget Office (CBO, 2016) projects the current year budget deficit at $544 billion or 2.9 percent of GDP rising to $1,044 billion or 4.4 percent of GDP by 2022, assuming real GDP growth rate being constant at two percent per annum. (Note that CBO estimates exclude transfer payments to show a government expenditure of around 21 percent of GDP, instead of 36 percent of GDP). The impact of such persistent fiscal stimulus on the US economy has not been well understood and will be elucidated here.

Suppose the current budget deficit is maintained at the $544 billion annual rate for 2016. The recent data show the US economy is slowing quite significantly. Suppose the US economy contracted by one percent annual rate in the last quarter of 2015. Then it is possible to illustrate the theory presented here by providing an estimate for economic growth in the first quarter of 2016.

The estimate suggests that a one percent unexpected GDP contraction in the last quarter of 2015 would have a flow-on effect of depressing economic growth by about 0.7 percent (annualized) in the next quarter, regardless of other developing influences. Of course if the authorities react with even more fiscal stimulus then the contraction would be even greater. Note that since 1970, apart from a few years of the Clinton hiatus in the late 1990s, government budget deficits have persisted, showing the US economy has been permanently under fiscal stimulus, depressing economic growth.

The analysis of the 2015 situation shows that fiscal policy is destabilizing because the government sector amplifies both expansions and contractions even without altering the level of stimulus. Fiscal deficits are automatically destabilizing with respect to economic fluctuations. In an economic contraction, reducing government spending and budget deficits is so counter-intuitive in the current paradigm that it will be most improbable. Counter-intuition should be valued, because if science does not sometimes lead to truths which are counter-intuitive, then why do we need science?

The reason why the above projections and estimates have any validity at all comes from the fact that there are substantial time lags in the incoming data, so that policy makers do not have sufficient time to react. An unexpected economic contraction in the last quarter of 2015 would not be confirmed until March and by the time policy changes are decided and implemented, in reaction to new data, the first quarter of 2016 would be nearly over.

Decades of fiscal stimulus have pushed the US economy to high levels of government debt, low investment and high consumption, closer to the Keynesian singularity defined as the situation where all economic output is consumed. It is interesting to consider what happens at, and beyond, the Keynesian singularity.

The Keynesian Black Hole

The Keynesian singularity represents a “phase transition” when the economy changes its character qualitatively, from a normal wealth accumulation mode to a wealth consumption mode. To draw attention to the alarming situation, the transition may be called here a collapse into a Keynesian black hole. But the transition may not be sudden or irreversible, and the economy does not cease to exist when it is in the black hole. Rather, inside the Keynesian black hole, an economy is shrinking instead of growing and, instead of wealth or capital being accumulated, capital is being consumed.

A simple analogy for an economy in a Keynesian black hole is a corporation in a financial black hole when it is making losses instead of profits. For a corporation making losses to continue to exist, it requires the consumption of investor capital. So long as the corporation is making profits it is a going concern, it is a sustainable entity and its balance sheet grows stronger with increasing net worth. But once the corporation starts making losses, its continued operation depends on its ability to draw capital from its balance sheet, which grows weaker with decreasing net worth. If allowed to continue, the corporation ends in insolvency, bankruptcy and extinction.

But a corporation does not normally fall into a financial black hole suddenly; it approaches the black hole gradually with a sequence of declining annual profits. If the corporation understands the reasons for its declining profits, it may be able to take action to stabilize the situation and arrest the declining trend which leads eventually to being sucked into the financial black hole.

The US economy has been approaching the Keynesian singularity for decades, as evident from its secular decline in economic growth – which is not officially acknowledged by economists or the government. The part played by perverse government policy in US economic history and during the GFC has not been well understood due to cognitive dissonance of the economic profession (Sy, 2016.1). Economic academics trained in the US have populated most key positions in government, both in the central banks and treasuries, not only in America but also all over the world.

The impact of American economics is not only intellectual. Due to the large size of the US economy and due to globalization of trade and free capital flows, US economic policy often has exaggerated impacts on smaller economies which are forced to take certain involuntary actions. For example, one percent of US GDP or about $180 billion flow into Switzerland would have an impact equivalent to 25 percent of Swiss GDP. The recent attempt to fix exchange rates by the Swiss National Bank (SNB), through currency intervention, has had such distortive effects on the national balance sheet that in January 2015 the SNB was forced to abandon its peg to the Euro.

The second and third largest economies in the world, viz. China and Japan, have obviously pursued government policies of economic stimulation, probably much more extremely – due to their relatively smaller sizes – in reaction to US policies. The details of how or what stimulations have been carried out differ between countries, but the objectives have been the same, namely to promote economic growth.

Initially both China and Japan have succeeded in achieving strong growth due to unique circumstances which have not been well enough understood economically, so that eventually when circumstances changed their economies faltered. Japan is into a third decade of failed Keynesian stimulus, while China has only started extreme stimulus measures since the GFC. The large number of ghost cities is stark evidence of wasteful consumption which has originated from property investments financed by state-owned banks using the large pool of saving from Chinese workers. When the Euro-zone economies are added to the top three economies, much of the world is pursuing similar stimulus policies to promote economic growth and yet the global economic growth has rarely been weaker.

Cognitive dissonance of the economic profession leads to blindness to the simple fact that the global economy may be in a Keynesian black hole. Potentially sinking the world deeper into the Keynesian black hole is a number of extreme and untested proposals to stimulate even more consumption through negative interest rate policy (NIRP), banning cash, debt jubilee, more quantitative easing (QE), QE of the people or helicopter money, etc. The universal premise is that consumer spending needs to increase and saving needs to be discouraged. These policy proposals, if adopted and implemented, would push the global economy through the Keynesian singularity and into the black hole.

As monetary policies have failed, there have been more calls for fiscal policy to come to the rescue with bigger budget deficits. Limiting increases in budget deficits, not eliminating them, has been called “austerity” in Europe, whereas in our terminology any budget deficit at all is already fiscal stimulus which increases consumption but reduces economic growth. The level of debt around the world is an indication of the amount of spending which has already been consumed and misspent given the weak growth of the global economy.

Inside the Keynesian black hole, beyond the singularity, the GDP of the economy need not be zero and can be finite, but the economy is actually shrinking. The reason it is shrinking is due to insufficient endogenous production to support the level of consumption. The excess consumption above endogenous production comes from running down the stock of national saving – sometimes called “eating the seed corn”. The exogenous consumption financed from saving is the wealth consumption which holds up the level of GDP, creating the illusion of a bigger economy than it really is.

The level of wealth consumption is directly related to the excess level (above GDP) of national debt, which is the financial vehicle for transferring the wealth of savers to the current consumption of borrowers. The process of wealth consumption accelerates if the level of GDP is to be maintained and ends with zero wealth, or with all seed corn eaten, unless deliberate effort is made to escape from the black hole. Many third world countries are in the Keynesian black hole where their economies are unable to accumulate wealth.

In the US and other developed countries, the post-war baby boom has created a significant cohort of savers who have accumulated lifetimes of financial assets and have begun to retire, drawing on their savings for retirement income. Financial assets are not real capital, as they are really only claims on future income of debtors (e.g. governments) and of businesses (e.g. listed companies). The values of these financial assets have been inflated by historically low interest rates which have been manipulated by central banks and do not reflect the true risk-adjusted values of those financial claims. Artificially inflated asset prices, called the “wealth effect”, may have tricked savers to spend more than otherwise they may have done.

Since the savings of American baby boomers have largely financed US government deficit spending in consumption, worth $19 trillion in government debt, the retirement savings of baby boomers have not been directed to investments to increase the income-producing capacity of the US economy. The broad evidence for this “borrow to consume” policy of the US government is the secular decline in the US economy, which has less and less ability to produce income from production. This means the financial assets for retirement are grossly over-valued partly due to low interest rates set by central banks, creating unsustainable asset bubbles.

The trillions of dollars of retirement savings of Americans will be seen eventually as a monetary illusion of wealth engineered to increase consumer spending. The idea, that Americans should partly or fully fund their own retirement through mandated contributions to pension and insurance funds, will be recognized eventually as another form of taxation to fund welfare spending in a socialist state. Many Americans have already sensed this situation and have continued to work past their eligible retirement age because they realize they cannot afford to retire. This situation will become more and more prevalent the longer the US economy is in the Keynesian black hole, which consumes national savings at ever increasing rates.

To escape from the Keynesian black hole, the US government should:

- Recognize that the US economy is in a Keynesian black hole and stop digging further with current policies.

- Ignore the advice of economists who did not see the GFC coming and who are singing the same songs which caused the GFC.

- Stop using fiscal and monetary policies to encourage consumer spending which is already excessive.

- Instead, encourage real private investment and increase net government investment by stopping and reversing the privatization of public monopolies.

- Reduce government budget deficits to balance or surplus as soon as possible.

- Reduce government current expenditure back to below 25 percent of GDP as opportunities arise to do so.

Adopting many of these policies is neither new nor difficult (Sy, 2015.6), because such policies have been achieved under Clintonomics at the end of the 1990s in a period called the “Great Moderation”; it was a period of sound economics which, perhaps, has not been well enough understood.

Globally, low economic growth and high levels of debt are evidence of the prevalence of “borrow and consume” policies adopted also by many other governments outside the US for decades. The lessons from the US economic decline, as described in this paper, may well apply equally to those other countries.

Conclusion

In the research paper for this post, scientific economics has been demonstrated by an approach which tightly couples theory with observational data (Sy, 2015.2). This way of presenting theory and evidence is probably unique in economics as well as in science. The theory has been compelled by facts, rather than by imagination. Only one simple assumption – the axiom of macroeconomics – has been essential. In science, the simplicity of the theory is strength not weakness. This scientific theory is proposed to replace the Keynesian theory which has been inconsistent with empirical evidence.

Contrary to the popular assumption that low economic growth results from insufficient consumer spending which then needs to be stimulated with fiscal and monetary policy, this paper shows that it is exactly the opposite in the case of the US economy which is already in a state of over-consumption. Over-consumption creates an unbalanced aggregate demand structure which is suboptimal, with inadequate net domestic investment and consequently low economic growth.

For decades, on a virtually permanent basis, government budget deficits have transferred personal savings to welfare consumption and thus have the effect of diverting resources away from net domestic investment, weakening economic growth. Decades of fiscal stimulus have increased consumption to unsustainable levels, causing the secular decline in economic growth and racking up a mountain of government debt – now over $19 trillion.

The premise that US consumer spending needs to increase is without empirical foundation, as shown in this paper. This premise is the basis of government policy for fiscal and monetary stimulation. This wrong-headed, unscientific government policy has caused the secular decline of the US economy and this policy is continuing even more recklessly.

As well as setting monetary policy for higher inflation, more recently, electronic bank deposits with negative interest rates and banning cash are desperate moves to force consumers to spend – in the “euthanasia of the rentier, of the functionless investor” (Keynes, 1936, p.376). Also, indiscriminate distribution of “free money” to all households, so called “helicopter money”, has been proposed to force still more consumer spending. Such policy errors, born of desperation and frustration, could push the US economy more quickly towards collapse and the Keynesian black hole.

The research paper has shown that the decline of the US economy and the GFC have been caused by harmful government policies, which have their basis in economic knowledge which has many fallacies inconsistent with the facts of reality. The economics, both orthodox and heterodox, taught at universities have flawed foundations. This begs the deeper question of how and why centuries of economic knowledge have accumulated so many fallacies. What exactly are these fallacies and why are they unrecognized? It is worthwhile pointing out the cause of these fallacies in a future post.

The natural consequence of Keynesian economics is stagflation. We have had it once in the 1970s and now we are having it again.

Helicopter money allows consumption without production, leading to a disincentive to produce and a decline in economic growth. Relatively more money chasing fewer goods results in inflation.

In the worst case scenario, the prognosis is hyperinflation and economic depression.

Many posts on this blog provide empirical evidence to prove the Keynesian fallacy. Recently, Lance Roberts has also independently come to similar empirical conclusions:

The Breaking Point and the Death of Keynes

His post confirms many of our reported findings. A few important comments need to be made here:

1. Hayek (1983) was ineffective against Keynes because his argument (not all of it correct) was rhetorical. The only valid method of falsification is through the facts of science which Hayek (1974) deprecated.

2. If inflation is measured (for most people) as the cost of living relative to wages, then the chart "Debt Used to Maintain Standard of Living" shows (see below) the inflation started in early 1970s, when most people started to consume their savings. When their savings were exhausted in early 1990s, they had to borrow more and more to consume. This is the Keynesian black hole of the US economy. The turning point from wealth accumulation to wealth destruction occurred soon after 1971 when a purely fiat currency system permitted unlimited US dollar creation.

3. Since 1990s, the borrowing merely represents consuming other people's savings. That is, most people who are lenders or "investors" with positive net assets have largely illusory paper financial claims. These claims are mostly over-valued because many will not be honoured. The claims on some debt will default because they are not self-liquidating (in the sense of Minsky) and future income from equity will disappoint because there has not been enough investment to increase productivity and profits.

4. The financial philosopher stone, in modern times, is the derivatives which are supposedly capable of turning paper into gold. As many times previously in history, the philosopher stone proved to be delusional. The nature and the true extent of derivatives have been kept secret from the public in a fraudulent global financial system. With the power and obfuscation of OTC derivatives, virtually all markets are rigged or manipulated, aided and abetted by central banks.

5. Like all Ponzi schemes, the end will come when the fraud becomes too complicated to manage. Inconsistencies and contradictions have begun to mount to such a level that maintaining the deception becomes all consuming and impossible to sustain. The enormity of the fraud to be revealed will be mind-boggling.