One of the first posts of this blog describes the potential for a Keynesian economic collapse due to persistent policy application, over decades, of the Keynesian fallacy. The fallacy originated from simple mathematical errors in Keynes’ General Theory which have never been corrected. Instead, they have been perpetuated in basic economic textbooks and form the foundation of government macroeconomic policy.

It is now so important to point out this fallacy that it is worthwhile repeating the argument and its refutation as simply and clearly as possible. On page 115 of the General Theory, Keynes (1936) wrote (suppressing inessential subscript symbols):

For , where

and

are the increments of consumption and investment; so that we can write

, where

is equal to the marginal propensity to consume.

Let us call k the investment multiplier. It tells us that, when there is an increment of aggregate investment, income will increase by an amount which is k times the increment of investment.

Spelling out the mathematics more clearly, we note that from the national accounting identity, involving national income, consumption and investment respectively:

, (1)

it follows that an equation for increments is:

(2)

Define the marginal propensity to consume c by:

(3)

Substitution of equation (3) into equation (2) and a rearrangement results in a standard textbook equation:

(4)

Introducing the Keynesian multiplier k by

(5)

it is seen, in agreement with Keynes (quoted above), that , where

is equal to the marginal propensity to consume c. The mathematical manipulations appear straightforward, but equation (4) is misleading and introduces the mathematical errors of treating the Keynesian multiplier k as the investment multiplier and suggesting that it is independent of other variables and can be fixed by policy. There is a number of errors involved in this fallacy.

- Mantoux (1937, p.109) and Sy (2014) noted that if everything is consumed then the propensity to consume would be unity, and investment multiplier (5) would be infinite. No other economist since Keynes appears to have suggested that this “singularity” is mathematically unacceptable. It remains in standard economic textbooks (e.g. Mankiw, 2006, p.790; Bernanke et al., 2009, p.214) causing havoc through government policies.

- The Keynesian multiplier k is not something that the government can set or change independently of

or

, given the mathematical logic above. The statement (Keynes, 1936, p.115) that “when there is an increment of aggregate investment, income will increase by an amount which is k times the increment of investment” is mathematically false. This is the foundation of decades of policy errors.

- The methodological error is to suppose that it is possible to start with an accounting identity, equation (1) and then infer a causal relationship or deduce a dynamic. This is a fallacy. Causality has to be empirically induced from observations or stated as an assumption (to be proven).

- The above theory is deterministic since there is supposedly a direct causal relationship between the increment of aggregate investment and its increment of outcome in national income. This determinism contradicts directly the belief in uncertainty which post-Keynesians assert is essential to the Keynesian philosophy (Davidson, 2009).

It is unclear why the error has remained undetected for so long. Perhaps it is the awesome reputation of Keynes. But in my school days, many of the students who were relatively weak in mathematics went to the C classes and studied business, commerce and economics. If this is a general reflection, it may explain the low level of technical skills among professional and academic economists. The mathematics on display in economic journals is generally not pretty.

There are many other Keynesian fallacies exposed by his critics (Hazlitt, 1977). But mistaking the Keynesian multiplier as the investment multiplier may be the most germinal of all his fallacies. Certainly, it occurs frequently in economic policies and has had the greatest impact in global economic outcomes – this is why it should be called here the Keynesian fallacy.

The Keynesian fallacy is defined as the false proposition that the investment multiplier is equal to the Keynesian multiplier (which is actually only the case for zero-growth equilibrium). The fallacy is very serious because attempts to increase economic growth by increasing consumption and the Keynesian multiplier would have exactly the opposite effect, as shown by empirical evidence (Sy, 2014).

Decades of fiscal and monetary policies to stimulate consumer spending have succeeded as desired in increasing the propensity to consume. But they have also resulted in mountains of debt (Sy, 2015c) and secular declines in economic growth in many countries, now risking a global Keynesian economic collapse. By increasing the propensity to consume, governments have also engineered corresponding declines in investment, as dictated by the accounting identity, equation (1).

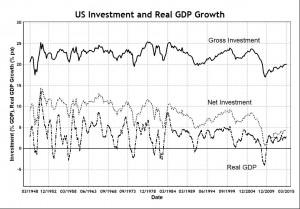

An example of declining investment in the US Keynesian economy can be seen in the chart below, using official data (BEA, 2015). A substantial part of gross investment is the consumption of fixed capital, which is the replacement of depreciating capital facilities to maintain current levels of production. For positive economic growth, there has to be positive net investment to increase production. Analysis shows that the 60 percent correlation in declining net investment and declining economic growth is statistically significant.

This chart provides the empirical evidence showing the Keynesian fallacy because increasing propensity to consume leads to decreasing net investment and decreasing economic growth, just the opposite of predictions from the Keynesian theory. Such a simple and obvious fact is not acknowledged, let alone explained, by economists who put the theoretical cart before the empirical horse in a serious misunderstanding of science.

As the propensity to consume rises and net investment falls over the decades, the goods and services produced domestically are no longer sufficient to meet domestic consumption demand. The deficit in consumption supply has been met with imported goods and services, which have been financed by both domestic and foreign debt because of insufficient earnings from reduced domestic production. Hence the measured GDP includes a component of consumption not endogenously created but financed by debt. If this component of consumption is to continue to contribute to economic growth, then new debt has to continue to grow as well. This is the spiral of debt and destruction of the US economy (Sy, 2015c).

Despite the fallacy of composition which says individuals cannot consume more than they produce, but a nation can, the empirical fact is: increasing consumption and decreasing production are not a sustainable strategy for long, even for a nation. Financialization has created innovative ways to mask temporarily the significance of ever growing debt, e.g. through asset bubbles, which make household and business balance sheets look much healthier than they really are.

However much valuations of financial promises have been inflated by artificially low interest rates, stock dividends and bond coupons have to be paid out of earnings which must eventually diminish due to declining production and income. Sooner or later it will be realized that zero earning discounted at however low rates is till zero, savings have been consumed (not invested) and many pension funds are bankrupt.

An asset market collapse (already started in China) may lead to recognition of the true nature of the economic problem caused by policies based on the Keynesian fallacy. Financial trickery of fiat money, debt and derivatives cannot mask forever the reality – it can only postpone, but not prevent, a rude awakening. The important roles played by neoclassical economics and financial markets in government policies will be placed in perspective in a future post.

An important Post:

Economics, as a Profession and a "Science" needs to brought to account and under the scrutiny of "scientific protocol" which as a faith-based cult has successfully avoided while bringing to Humanity, continuous Wars, suffering through financed Ideologies and other disastrous attempts at Totalitarianism by criminal opportunists and murderous charlatans. But this is what we can only expect from the proto-Human and his preferences for the inherited practices of the political cult with its expediencies via Dogma du jour.

There are and remain too many assumptions and peanut gallery cheering from feeding and looting cronies where the subjective interests rule a priori. What are the definitions of "money", "capital", "wealth"? What are GDP and what the hell is CPI based on? None of these terms when defined by mainstream economists and central bankers pass the smell test.

Increases of costs of goods in the community are generally in line with increases of 15% and more and do not reflect whatever the hell governments reports. Counsels raise rates every year with other surcharges which are "additional" and explainable. Government spend and spend and spend and are more often than not found with their hands deep into the pockets of trusting and gullible naive citizens. Is is wrong to be trusting? Does this question and similar question arise in "economics"? If not why not?

If you don't know what "money" is, how can you be in charge of "money", capital, debt, credit, interest rates?

From my experience, these so-called Economists who quote Keynes do so as a ruse and the only Economic Theory is political expediency; in other words, they do what they are told and expected to do.

So, an important post as we must whittle away at the authoritarian "smoke and mirrors" aka crass ignorance but expediency, until this social science of economics transmutes from a priestly cult of the pious to an established science founded in scientific principles - for the Objective benefit of the society, that is, Humanity as whole.

In the meantime, we must see clearly as pointed out herein and other posts and works by credible professionals, that the mathematics behind "economics" is sophism and without merit, whereupon that which is the practice of economists today, is false assumption, stealth for the political, the private agenda of the influential and above all, the strengthening of the banking system for the Banker elites, a priori, and foremost amongst the elite Collectives and all that hangs off them.

Ask why with growing unemployment is Australia, nothing new, why is the government supporting the further importation of contract foreign workers (who work on cheaper contracts than Australians)? Why has secrecy in government operations taking over established Policies of Transparency and Accountability? Is it true that the rich spend more money and hire more people that small business? (it is not). Why are the marginal targeted for larger taxation contributions than Big Business.

I could go on forever, but I will finish here by stating that it is most welcomed that failed theories are challenged mathematically, but at the same time, the basic assumptions of "economics" need also to be challenged. The Banking System needs to be challenged and above all, human behaviour needs to be analyzed in order to establish that it is exactly this, human behaviour, that is the fundamental underlying causal force, albeit cyclic, that creates "economics".

In the end, the fish rots from the head, or, stated in other terms which are scientifically correct and proven so, the social environment or better, milieu, that is created by the human interaction and stage managed by the elites and the influential, determine absolutely, these flavours, colours, and humids of social behaviours and their integrity - or in fact, lack of integrity.

Rotten politicians, a rotten and corrupt system in which all plays. This is "economics".

I recommend: MANHOOD of HUMANITY

BY

ALFRED KORZYBSKI

AUTHOR OF SCIENCE AND SANITY

An Introduction to Non-aristotelian Systems

for tomorrow, there is hope.

While I am the mood:

A lesson for the so-called meal-ticket "Economists", particularly those so called "academic" elites that impose their assumptions (read: opinions) onto governmental (sic) Policy.

1. If there was no corruption throughout the realms of man, Humanity would die out in x3 generations.

2. If we humans adopt a strict Policy of Political Correct as our a priori behaviours, Humanity would die out in x3 generations.

3. If humanity "trusted" as a whole, Humanity would die out in x3 generations.

"There is one safeguard known generally to the wise, which is an advantage and security to all, but especially to democracies as against despots. What is it? Distrust." -- Demosthenes

You see, dear Reader, Economics, is about "control" and always has been since at least Marx and Engels; nothing more.

Gold does not vary in its value.

When the US Dollar and other fiat currencies finally tanks, it will be worth nothing.

As a consequence Gold could be quoted as trillions of US dollars per troy ounce - it is immaterial and of absolutely no consequence.

What is of consequence is that China will not release any of its Gold Bullion used for supporting its Promissory Notes and economy and hence most people in the West may never see Gold again - and never have the opportunity to hold it except in some fictitious form. In fact, fictitious is what the West has become; delusion; denial and duplicity.

http://verbewarp.blogspot.com.au/2006/03/warning-to-east.html

As the USA becomes a failed Totalitarian State, most of its John Gaults will leave - too bad about the innocents - this is the direct result of failed "leadership", not the economy and leaves this once proud Nation of Liberty, Freedom and Justice feeding on its own; the shadow of its former self.

Putting a Banker (system) in charge of your Society's Government does this, as 5,000 years of written history has shown clearly and repeatedly.

This is Economic Theory - in real terms; albeit in brief.

For ~5 thousand years and more, men have banded together in Collectives primarily to steal the capital, wealth and productivity (I repeat myself) of those producers which are not organized as military aggressors - as they. The Collective is an oppressor, and aggressor, thief, murderer, liar, cheat, etc., etc., bent on Totalitarian control of those that cannot protect themselves; a Parasite.

The political, governance, institutional, banking systems of the World today are and remain such Collectives; the ignorant, the incompetent, where in its animal strength is aggression, stealth, deception and false doctrine induced into the population from birth. In short, it is all a Lie.

And, "Economic Theory", or "Economics" is this Lie. It serves the Banker, and all that hangs off - at the cost of Humanity. Man is not an animal; Man is a dynamic and evolving Universal Force, unfortunately, today, trapped by those that reject change; the statist.

Ho hum

These days, western education is a profit-driven business selling meal-tickets. Milton Friedman (1970b) said "the social responsibility of business is to increase its profits". How do you increase profits in education? Charge higher fees to increase revenue and lower quality to reduce costs.

In the UK, the result for economics education is a "9,000 pound lobotomy" (Chakrabortty, 2014). In US education, there is a trillion-dollar student loan-bubble and "Nobel-prize" economics professors who are frauds. For example, Krugman said:

Krugman is mistaken because the stuff doesn't work and therefore he is a fraud. He made the claim "the stuff works!" less than three minutes into the following video:

https://www.youtube.com/watch?v=Si4iyyJDa7c

His comment on Bitcoin (which I don't have) at around 1:06:00 shows an appalling ignorance about money, consistent with his remark that "debt is money we owe to ourselves".

The best thing in the video is Thomas Piketty who is modest and understands the boundaries of his knowledge. The fact that he is the youngest is the basis for optimism. I also admire him for turning down the award of Legion d'Honneur, France's highest political honour.

With respect, the name of your Thesis (Blog) is "A Scientific Economic Paradigm Project".

Define: Economics, Capital, Wealth, Production, Milieu, Humanity, Man, Knowledge, Life, Money, Gold, Values, Risk, Evolution.

Just for Starters. We need an established Lexicon in order to satisfy the Objectives of your Project "A Scientific Economic Paradigm Project".

And the Math?: We need to become brutally precise and begin at the most fundamental levels, if you are to achieve your goals, herein.

But, I am with you - for the moment. I follow integrity.

Peter, you are absolutely right in demanding rigour for this project and for economics generally. Yes, definitions are necessary where they are important and possible. Some of your demands are met here: http://www.asepp.com/definitions/

Some definitions such as "economics" and "humans" can only be tentative because they are themselves subjects of research. The definitions are useful and successful if they lead to a coherent and consistent body of scientific knowledge. Hence definitions of economics and humans are actually axioms or assumptions for a particular enquiry. Humans cannot be universally defined - a subject for a future paper. But for this project the axiom of "humans" is here: http://www.asepp.com/axioms/

For example, in neoclassical economics, according to Lucas (1988), humans are robots with "reasoning" (see References page for citation). This explains why neoclassical economics is inadequate.

Also economists have generally confused money, capital and wealth which I have defined and will be discussing in a future paper on "money". Money is an important topic generally debauched by academics.

QE4 Coming?

Governments have tried all policies based on unscientific theories and have been reluctant to accept failure. Rational expectations, forward guidance, fiscal and monetary stimulus etc. do not work to restore long-term "equilibrium" against the forces of economic reality. What next?

Here is a simple game-theoretic argument that QE4 is virtually guaranteed, based on one simple assumption: central bankers are humans who look after their own self-interests ahead of those of others. Recent developments require central bank decisions with only three possibilities: raise rates, do nothing or (with official rate already zero) quantitative easing (QE).

The global economy is weakening and stock markets are crashing. Raising interest rates is virtually out of the question. If central bankers raised interest rates, they would be accused immediately of not understanding economic reality. If they did raise rates and the economy improves, they cannot explain why it worked (as suggested here) and therefore get no credit for it. If the economy worsens, the central bankers would get the blame and cop abuse for doing the "obviously wrong" thing. Hence raising rates is not in the interest of central bankers.

If central bankers did nothing and the economy improves then that outcome would prove that central bankers are redundant and therefore dispensable. If they did nothing and the economy worsens then they get blamed for inaction. Hence doing nothing is also likely not an option. They must be seen to be doing something. There remains only one last option which is QE.

If central bankers do as they have always done which is to provide monetary stimulus then they will be blameless because it is consistent with mainstream Keynesian economic theory. If the global economy continues to collapse even with stimulus then the usual excuse is: they should have been more forceful against the unanticipated external shock. Central bankers would not get the blame for pursuing the conventional wisdom. If the economy recovers then the central bankers will be vindicated, treated as maestros and heroes who had the courage to do the right thing.

Hence only QE can have a potentially positive outcome for the central bankers, if not for the economy. As always stimulus is the only recourse in a world of lobotomized economists. Buying time at greater and greater cost is all they know and all they have ever done. Already economists are saying and repeating "Debt is good" and "Krugman is right - public debt is good!".

Unless someone in charge is totally altruistic and knows what they are doing, QE4 is almost a certainty. Any other action would be considered reckless if successful and criminal if unsuccessful. Keynes (1936, p.158) observed correctly: "Worldly wisdom teaches it is better for reputation to fail conventionally than to succeed unconventionally". The can will be kicked down the road until eventually: Keynesian economic collapse.

I am in total agreeance with your comment above.

In the Collective, the binding myth (read: belief system / paradigm) and its ritualized dogma, rules supreme. All obey. There is no dissent, no courage, no individualism; this is the Garden; timeless and thoughtless; Plato's Cave.

Quantitative Easing (QE), as I have previously said, destroys employment and will destroy many nations. The FedRes, despite a recent paper suggesting that Dr. Bernanke's academic paper on the subject matter was inadequate, lacked credibility and substance (from within the FedRes itself), in regard to QE, will follow and act according to the binding belief system of the Banker Economists that feed off this Temple Collective. To make a decision to the contrary would take selfless courage, objectivity and responsibility - in terms of Humanity.

The Collective has no head; it is subjective to itself and its own survival and affairs. To this end, the Banking System indulges in tribal nationalism; the New Global Order and ignores well established science as one would expect of any politicized cult.

"Politically speaking, tribal nationalism always insists that its own people is surrounded by "a world of enemies", "one against all", that a fundamental difference exists between this people and all others. It claims its people to be unique, individual, incompatible with all others, and denies theoretically the very possibility of a common mankind long before it is used to destroy the humanity of man": Hannah Arendt, from her book The Origins Of Totalitarianism p.227

Any singularity (read: Collective) which becomes empowered with the possibility of domination over those around it, will impose upon those despite all ambivalence from within. This is an Universal Principle. As the governing belief of the majority (read: proto-Human) today is that man is an animal, then this Principle is the expectation.

So, due to the above, QE will be repeated, guaranteeing without any doubt that the whole structure of demographic organization will collapse. Mileage will vary. The cycles guarantee this scenario and the proto-Human is subjected to these cycles. And while this state of affairs continues, we can expect woe and not weal.

The science of Economics needs to be established under scientific scrutiny and practice. It is important to humanity. Mathematics does not make a science and hence not a forecaster but it is an excellent describer. Today. Economics is nought but a faith based cult which has been politicized on behalf of the Banking System, by the meal-ticket institutionalized "economists". Enough said.

Human behaviours are consistent throughout eternity. It is the state of the milieu of the Banking System, its structure; its organizations; its functional mandate; its discipline; its integrity; its responsibility; its service to Humanity as a whole that needs to be re-ordered as this alone, within the associated Collective, evokes either good, or bad human behaviours and accordingly impacts on civilization as a whole.

Is there no person in the FedRes or the Cult of elite Economists - in a position of "leadership", that feels any compassion for his/her fellow man? Are we so blind we cannot see? Or, is it that we prefer not to look?

I leave the reader a link to a very well presented presentation on the Collective and with the comment that these problems were well known ~6,000 years ago., leaving one to acknowledge that it is really hard work to remain ignorant.

https://www.lewrockwell.com/lrc-blog/hidden-influence-the-rise-of-collectivism/

Ho hum

And, the Banker has become King: His Word is Law

Long live the King

"That is simple. In the Colonies we issue our own money. It is called Colonial Scrip. We issue it in proper proportion to the demands of trade and industry to make the products pass easily from the producers to the consumers. In this manner, creating for ourselves our own paper money, we control its purchasing power, and we have no interest to pay no one." -- Benjamin Franklin (1706-1790) US Founding Father Source: Explaining to Bank of England directors his ideas on why the colonies were so prosperous (1763); as quoted in The Money Masters (1995).

"The government should create, issue, and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government's greatest creative opportunity. The financing of all public enterprise, and the conduct of the treasury will become matters of practical administration. Money will cease to be master and will then become servant of humanity." -- Abraham Lincoln (1809-1865) 16th US President

"The death of Lincoln was a disaster for Christendom. There was no man in the United States great enough to wear his boots and the bankers went anew to grab the riches. I fear that foreign bankers with their craftiness and tortuous tricks will entirely control the exuberant riches of America and use it to systematically corrupt civilisation." -- Otto von Bismarck (1815-1898) Founder of the German Empire, Prime minister of Prussia, Germany’s First Chancellor after the Lincoln assassination