Nearly 80 years of Keynesian fallacy has brought the global economy to the edge of collapse. Governments everywhere love Keynesian economics which axiomatically requires governments to spend to maintain aggregate consumption in their economies. What is there not to like about the idea that you can spend your way to prosperity?

The fallacy is captured in a little mathematical formula called the Keynesian multiplier k, given in all introductory textbooks (e.g. Mankiw, 2006, p. 790) as

The propensity to consume c is the ratio of aggregate consumption to total production (GDP). Keynesian theory asserts that each dollar of new investment produces k dollars of economic output.

Increasing the Keynesian multiplier is the foundation of government policy in most advanced economies. The $787 billion Obama stimulus package in 2008 was explicitly to increase the US Keynesian multiplier through increased consumption in the financial crisis. Recent zero interest rate or negative real interest rate is a deliberate policy to induce more borrowing and spending. Asset bubbles are officially encouraged so that people feel wealthier and spend more.

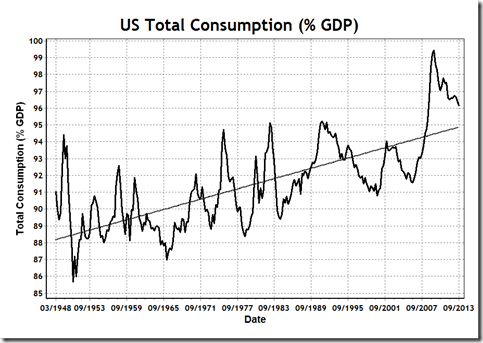

Decades of relentless application of Keynesian economics have succeeded in producing a steadily rising trend in the aggregate consumption of the US economy as seen in this chart:

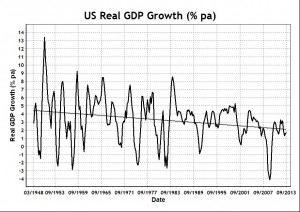

If Keynesian economics were right then this rising trend in total consumption (private, public and capital) should lead to a corresponding rising trend in economic growth and prosperity. Not only did this Keynesian prediction not occur, the empirical data show just the opposite in this chart:

These facts of observation represent a scientific refutation of Keynesian economics. In a research paper containing analysis of the theoretical origin of the Keynesian multiplier, we find that economic growth is given by the formula

The investment multiplier denoted by is only equal to the Keynesian multiplier k when the economy is in static equilibrium, when there is no growth

. For positive growth, the investment multiplier has to exceed the Keynesian multiplier, which is then a minimum threshold value for investment efficiency to produce economic growth.

Hence government policy of increasing the Keynesian multiplier has exactly the opposite effect, resulting in retarded economic growth for given investment efficiency. If policy increases in consumption are so large that c is nearly one, then k is large and is negative and approaches -1, which represents a substantial contraction, defining economic collapse. Except for massive monetary intervention, the empirical evidence shows that decades of Keynesian fallacy has brought the US economy to the edge of collapse.

Economic collapse may be avoided by a timely abandonment of the Keynesian fallacy. The teaching of the Keynesian multiplier in economics textbooks has been harmful and unscientific; it should be modified or abandoned altogether. This conclusion is completely independent of political ideology.

I am not totally convinced that you you show what you claim to.

You conclude "Hence government policy of increasing the Keynesian multiplier has exactly the opposite effect, resulting in retarded economic growth for given investment efficiency." It seems to me that government policy is mostly designed to increase income, on which the multiplier operates. This probably has some indirect effect on the size of the multiplier - but if you incorporate taxes you can directly affect the size of the multiplier. The multiplier can work in both directions, so that reductions in income are amplified as well.

Are there other possible causes of the demonstrated decline? I know that as economies grow in absolute size, it simply becomes more difficult to maintain a constant high grow rate. Economies tend to grow quite quickly early on, and experience growth slowdowns over time. Here, you claim that the cause of the observed slowdown is increases in consumption. Is this deep enough? What leads people to increase consumption when their incomes might be stagnating or falling? Consumer debt is at or near record highs right now, and there has emerged a wide split between measured productivity and real wages. Given real wage stagnation, I am not sure there is enough evidence presented here to rule out massive increases income inequality as a cause.

Ideally, I would like to discuss the possibility of several causal factors and there interactions as playing a role. Here I have suggested the possibilities of a trend over time, changes int he multiplier brought about by changes in tax rates, and the change in income inequality operating through consumer debt and savings. I want you to know that I am NOT dismissing this out of hand. It is a serious question deserving of a serious answer.

Government policy is justified on many grounds, all of which are plausible, but never proven. The only fact of observation which matters in my analysis is that government policy (fiscal and monetary) managed to create a rising trend in the propensity to consume.

The government (e.g. Obama) has explicitly and publicly mentioned a desire to increase the Keynesian multiplier which can only be achieved by increasing the propensity to consume. The data prove that they have succeeded. There is no need (for my purpose) to speculate on how the Keynesian multiplier works in detail.

There is also no need to speculate on other possible causes, because I have demonstrated one sufficient cause: over-consumption. One can speculate on why over-consumption occurs. But that is not my purpose. My proof of Keynesian decline is based on only one assumption, which is supported by the data viz economic production and growth come from net investment and investment efficiency.

More consumption leads to less net investment (an accounting identity) and hence to reduced growth beyond a certain level of consumption. (Have you read my full paper linked in the post?)

Questions such as how employment, income inequality etc. affect people's consumption are not directly relevant to what I'm saying. The government can control consumption (total public and private consumption) by taxation, deficit spending, interest rate policies etc. Overall private consumption in the US has been maintained (see the data) for all earners through the welfare state with transfer payments, food stamps, health and education subsidies etc.

The only empirical fact I need to reach my conclusion is that the total consumption in the US, as a percentage of GDP, has continued to rise, and will continue to rise if the policy to increase the Keynesian multiplier continues. A high Keynesian multiplier will lead to economic collapse. It is just a simple mathematical statement, much like saying if cost increases faster than revenue, a business will eventually go bankrupt. It is a simple but profound truth, which economists have failed to see.

Thank you. I started reading the linked paper today, but I will not have time to finish. I expect to have a more substantive reply later this week.

Some careful readers of Keynes have noted that there might be a difference between the short term effect of investment spending and the long term effect. Keynes himself may have been aware of this, but I am not sure about that. Investment spending on things like factories, schools and hospitals adds little to productive capacity in the short run, while putting otherwise idle resources to use. In the long run, investment adds to productive capacity, both in quantity and quality (as technology changes or improves). Given this, I can easily see how a government might be unwilling or unable to change direction easily once the country begins to travel down this path.

For, now, that is all I have. Like I said, I will be reading your paper with great interest.