For several decades, the historical data show that the monetary policy of central banks has been to use debt to stimulate the global economy, constrained only by the possible emergence of high inflation. This post shows that the policy has been economically destructive for US economic growth and, with more audacious pursuit of such a monetary policy recently, the risk of a Keynesian economic collapse has increased substantially (Sy, 2014).

A few decades of US monetary stimulus has led to zero or negative interest rates and the accumulation of a mountain of debt, which economists confuse with money and consider as innocuous, because “debt is money we owe to ourselves” (Krugman, 2015) or “one person’s debt is another person’s asset” (Fatas, 2015). Of course, debt is harmless provided it does not lead to bad loans or credit defaults, which are assumed negligible and ignored in standard economic theories taught at universities. The reality is very different.

Debt is the financial vehicle through which future spending of savers is transferred to current spending of borrowers. The transferred spending from savers to borrowers may be consumption or investment and saving is not always invested (Sy, 2014b). If the spending from the debt is good investment which leads to income exceeding the cost of capital borrowed then the debt will be repaid to savers for their eventual spending (Minsky, 1992).

If the spending from the debt is bad investment or consumption then there may not be the means later to repay the debt to savers who may have lost spending through default of the borrowers. In this case, debt represents purely a bringing forward of spending and economic growth, in lieu of future spending and economic growth. Debt then merely allows greater current spending and creates temporarily the illusion of current prosperity at the expense of future prosperity.

Debt Not All the Same

Comparing debt levels relative to Gross Domestic Product (GDP) across many countries in a so-called panel data analysis is a meaningless statistical exercise (Reinhart and Rogoff, 2013) because it involves an unscientific fallacy which assumes ceteris paribus – all else are equal. All else are rarely equal. Different countries have different structures of aggregate demand and therefore debt levels per se could have very different effects on economic growth in those countries.

For example, as Fatas (2015) correctly indicated, Singapore has government debt exceeding its GDP, even while its government runs budget surpluses. The debt has not come from funding government consumption. The debt in the form of government bonds has been issued for the purpose of helping the investment of the Central Provident Fund, Singapore’s national pension system. The debt has been created to transfer national savings to fund investments by the Singapore government, which has substantial assets in a very sound balance sheet. But Singapore is a misleading example. In many other countries, the typical origin of national debt is usually to fund consumption, and not investment, unlike the case for Singapore. This paper shows that the similar debt level to GDP of the US economy has been mostly to fuel consumption, thus indicating a significant risk for the US economy (Sy, 2014).

Consumer Spending

Since the global financial crisis, a past US Secretary of the Treasury and now a Harvard professor, Summers (2011), has repeated on several occasions that

…the central irony of financial crises is that they’re caused by too much borrowing, too much confidence and too much spending and they’re solved by more confidence, more borrowing and more spending.

The need for more spending is echoed widely in the media and approvingly by the chairwoman of the US Federal Reserve, Yellen (2014), who said in an interview:

Our policy is aimed at holding down long-term interest rates, which supports the recovery by encouraging spending. And part of the [economic stimulus] comes through higher house and stock prices, which causes people with homes and stocks to spend more which causes jobs to be created throughout the economy and income to go up throughout the economy.

More recently, Nobel laureate Stiglitz (2015) diagnosed monetary policy ineffectiveness in stimulating economic growth, saying in an interview:

The lower interest rates have led to a stock-market bubble – to increases in stock-market prices and huge increases in wealth. But relatively little of that’s been translated into increased and broad consumer spending.

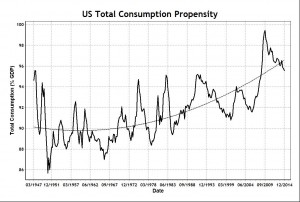

Previous papers (Sy, 2014, 2015) have shown that there has never been a lack of consumer spending in the US economy. According to BEA data (2015), between 1965 and 2014 private consumption increased steadily from under 60 percent of GDP to nearly 70 percent. Total consumption, including private, public, fixed capital and external sector consumption, increased from a low of 86 percent of GDP in 1950 to a high of over 99 percent in 2009. The belief that lack of consumer spending is the cause of slow economic growth is an enduring Keynesian fallacy, because the belief can be shown to be factually false in the US and elsewhere for several decades.

Debt Financed Spending

Research shows that for several decades US policy has been to generate economic growth through consumer spending financed through debt or fiat money. This Keynesian policy of continual stimulation of the US economy has led to a mountain of debt and a destruction of economic growth. The causal mechanism of how this occurs has been identified in this post. The over-consumption structure of US aggregate demand has led to lower economic growth which in turn called forth more monetary stimulus, more new debt, greater propensity to consume and lower economic growth, in a vicious spiral of increasing debt and destruction of the US economy.

The US economy is pivotal to the global economy because it is the largest economy in the world; the US dollar is nearest to being a global currency; and, through free capital flows and flexible exchange rates, US monetary policy is transmitted widely and has direct impact on the rest of the world. Hence, for better or worse, US policies are often echoed in those of other countries, though this situation may be changing due to relative US economic decline.

Debt and Consumption

Since the 1980s, easy monetary policy in the US has often led to credit growth exceeding economic growth. This credit growth has been used to finance the rising trend in propensity to consume as observed in the following chart.

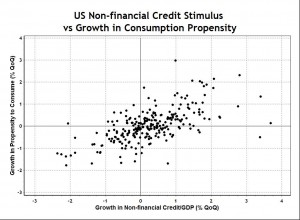

The increased consumption has been financed by debt (or credit). The data used for credit is non-financial credit which includes household, business, State and Federal government credit. The relationship between borrowing and consumption spending is evident even on a quarterly basis. Credit stimulus is defined by when the growth in the variable (Credit/GDP) is positive. The chart below shows that credit stimulus generally leads to increases in the propensity to consume, as economic policy had intended. The correlation is statistically significant at 62 percent.

Note that since nominal GDP is in the denominator of both of the variables in the above chart, the chart also displays (with only a change in axis labeling) the direct relationship between total consumption growth and the growth in non-financial credit, indicating a strong positive correlation and showing US consumption being financed by debt.

Consumption and Growth

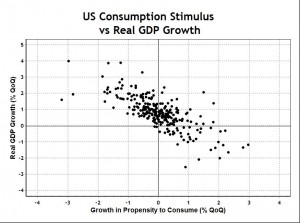

For the US economy, which was already supply-deficient, further stimulation of consumption demand through debt financing has been shown (Sy, 2015) to be counter-productive. The following chart shows that consumption stimulus from increasing the US propensity to consume leads to decreasing economic growth and increasing probability of economic recession, with a statistically significant anti-correlation of -77 percent.

This chart exposes the fallacy of the Keynesian investment multiplier (Sy, 2014) and of the assumption that any type of spending or activity will stimulate economic growth (including digging holes in the ground). Even though Keynes had a preference for investment, he nevertheless saw consumption also being effective in stimulating economic growth and employment. Keynes (1936, p.325) stated that, if policy stimulus does not bring forth increased investment, then the remedy is increased consumption:

If it is impracticable materially to increase investment, obviously there is no means of securing a higher level of employment except by increasing consumption.

The above chart shows that this Keynesian prescription of consumption stimulus has been counter-productive. It has been shown (Sy, 2014) that it matters a great deal what is the actual structure of aggregate demand arising from the spending, as there exists an optimal split between consumption and investment for economic growth. Indeed the data show that, for the US economy, negative growth in the propensity to consume is correlated with positive real GDP growth. This may be construed over-simplistically as an argument for austerity for the US economy, though the real reason lies in the structure of aggregate demand, which is more important than simply the level of aggregate demand for economic growth.

Debt and Growth

The net result of easy monetary policy and excessive credit expansion has been a rising propensity to consume (see the first chart) and the destruction of the US economy, which has been proceeding largely unnoticed for the past several decades. Unquestioning acceptance of the Keynesian dogma has been inculcated into popular belief through the economics education system, now reaching into all areas of government policy, including those of central banks.

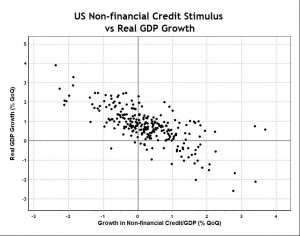

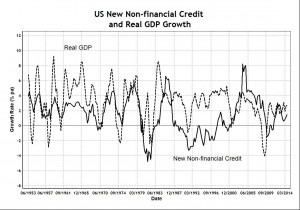

The overall impact of Keynesian policy of relentless monetary stimulus can be seen in the following chart, showing that excessive credit growth above economic growth is associated with lower economic growth and recessions – the greater the monetary stimulus the lower the economic growth.

The anti-correlation is statistically significant at -72 percent. But by itself, the clear anti-correlation shown in this chart is insufficient to infer causality, because credit growth above GDP growth might have been entirely attributable to an unanticipated decline in economic growth. But this explanation can be dismissed on the basis of the relationship between credit growth and debt-financed consumption shown in the second chart above and the relationship between over-consumption and decline in economic growth established in an earlier study (Sy, 2014), as displayed also in the third chart of this post.

Debt and Destruction

To supplement the over-consumption explanation of secular stagnation and decline, a second approach to establishing causality is by examining the temporal sequence of credit growth relative to economic growth. Causality requires event A to occur before event B, if A can be said to cause B. The time series data show (see Research Paper) that, whenever the rate of change in the Credit/GDP ratio fluctuated around zero, as in the 1960s and 1990s, the US economy grew relatively strongly and steadily, without recessions. Whenever the growth rate in the ratio is high, as in the 1950s, 1980s and 2000s, the US economic growth became more volatile with recessions.

Evidently excessive debt generally led to unproductive consumption or investment and ultimately caused economic destruction (recessions) from over-consumption, over-capacity and under-investment in sound production (Sy, 2014). In a fiat money system there is virtually no financial constraint on debt creation, allowing excessive debt to become an economic problem in resource allocation.

Deleveraging

It is the data on new debt or paying down debt (deleveraging) which may indicate most clearly economic decisions and deliberate actions which have the strongest impact on the economy. The annual rate of new credit creation can be obtained by subtracting the interest rate for debt servicing from the actual credit growth rate given by the raw data:

Growth rate of new credit = Growth rate of credit – interest rate of debt service

The relationship between the growth rate of new credit and real economic growth rate is shown in the chart below.

There have been few deleveraging episodes where there were reductions in debt rollover leading to an effective paying down of debt: a few years in the early 1980s, about a decade in the 1990s and a couple of years after the global financial crisis (GFC). Whenever new credit growth rose above 4 percent, it was followed three to five years later by a recession. On the other hand, the periods of negative new credit growth or paying down debt were usually followed by several years of strong growth, particularly in the 1980s and 1990s.

This observation is consistent with fact that debt represents the bringing forward of future spending. Whatever stimulating effect that increased excessive debt has on economic growth, it has to be paid for by a lower rate of growth in a future period. The assumption that excessive debt is a problem solved by stronger growth is falsified by the facts of observation which show excessive debt causes weaker growth.

Clintonomics

The 1990s were the halcyon days often referred to as the “Great Moderation” for which economists (Bernanke, 2004) have few explanations, with Greenspan (2007, p.367) attributing it to the invisible hand of Adam Smith. The economics associated with the Clinton presidency was exceptional. Far from expanding credit to fuel economic growth, as commonly believed, the US economy was actually paying down debt, with negative rates of new credit growth, as seen in the above chart.

The Clinton years (1993-2001) can be characterized by a period of tightening monetary policy (rising Fed funds rates), government austerity (increased tax receipts and decreased outlays) and debt-deflation (paying down debt), all of which are widely dreaded as “deflationary” today by economists and the public media (Krugman, 2015b; Sen, 2015). Yet the US economy grew strongly and steadily at 3.8 percent per annum with record low unemployment of 3.9 percent. (For details see Research Paper.) Those eight years of economic facts, which are rarely mentioned, should have exploded many Keynesian myths.

The reason for this apparently miraculous performance was a reduction of total consumption by 3.2 percent of GDP, with a corresponding increase in net investment, which is the main driving force of economic growth (Sy, 2014). This restructuring of aggregate demand came from a reduction in government expenditure, because after years of privatization of public investment assets, the government has a lower ratio of investment to consumption expenditure than that of the private sector. Therefore, a reduction in government expenditure leads to an increase in the ratio of investment to consumption for the overall economy.

Debt Spiral

The Clinton years were a notable hiatus in decades of US policy which has been to generate economic growth through consumer spending financed through debt or fiat money. As a Republican congressman, and later a government budget director, noted (Stockman, 2013, p.276): "But Bill Clinton's courageously balanced budgets were the last hurrah of fiscal orthodoxy". Excessive debt generally distorts the structure of aggregate demand by suppressing the ratio of investment to consumption. Long-term economic policy has created an over-consumption structure in US aggregate demand, which has a lower potential for economic growth.

Whenever economic growth falters, more monetary stimulus is called forth, leading to more new debt, greater propensity to consume, unbalanced aggregate demand and lower economic growth, in a vicious spiral of increasing debt and destruction of the US economy. A previous study (Sy, 2015) suggests that there exists an optimal split between investment and consumption for the US economy. But since the US economy is already in the over-consumption regime with sub-optimal economic growth, excessive debt creation has been leading to greater and greater over-consumption relative to investment. The result is economic stagnation followed in recent years by accelerated decline, potentially a Keynesian economic collapse (Sy, 2014).

Wasteful spending financed through debt has infected many other countries, including Japan and more recently China. In a global fiat money system with financial innovation and Keynesian policy, debt provides inadequate constraint on bad economic decision making. Debt is an economic problem created by financial innovation, where imprudent debt enables wasteful spending which destroys real capital and global savings where “one person’s debt is another person’s fictitious asset” and “debt is money until it isn’t”.

For further discussions see the Research Paper.

Thank you, I am in. Have actually missed our interaction back then so am pleased that you brought your pages to my notice.

My intuitive feeling is that there will be a small event Q4 2015 that will bring a loss of confidence in "leadership" (per se) and then there will be little holding aircraft humanity true for a time: Australia should be better off than most nations but our standards suggest there is a long way to fall and the Big 4 Banks and their Assets in Real Estate (debt) concerns me.

"Quantitative Easing" (QE) is a "game changer" for the TBTF - and it creates unemployment which inserts a whole new set of statistical behaviours in the way money credit and debt is attributed and animated. What is sure At least to me, is that QE is a destroyer of Societies and peoples. Do these "meal-ticket' economists even consider what will happen to their consumerism models with these Policies?

The question begs, why is the US destroying its own nation as well as other nations: My answer after much consideration is that the US is already finished and is now in the biological state (in analogy) of "extremis". The nature of this state can be viewed as a crazed animal lashing out at all and sundry in the impossible attempt to stay alive; death throes.

We are now seeing the absolutely crazed idea of the cashless state, more taxes, stealth taxes, withdrawal of what have become normal services, oppressive and stealth invasion of privacy, computer monitoring, corruption in the bureaucratic and political services and Hallowed Halls of the political "elite", etc., or in other words, the fear of the ruling elite to be replaced. In other words, the smell of revolution is in the air, and the elite are not just drawing the lines, but are attacking. And all this to protect the Banking System. They don't see because they refuse to look.

Totalitarianism knocks (again) and its comes with the stench of fear of the "elites". Why? Because they know. Seeking the truth saves you; walking the road in search of truth is what saves you; the truth itself does not save you.

Thank you for having me here. pjb

Ho hum

Peter

Welcome, your views are always worth hearing,

"QE is a destroyer of Societies and peoples" - very true. Quantitative easing is central banks printing money to buy bad loans in the form of over-priced securities from TBTF banks, in the name of providing liquidity, but actually to bail out insolvent banks - truly creating moral hazard. This is socializing private losses - the other side of privatizing public profit (selling public monopolies).

QE, privatization, public-private partnerships, out-sourcing, market-rigging, etc. are all facets of the same scam involving criminals in high-office in business and government. Market bubbles and crashes are all engineered to transfer public wealth to the "elite". This explains "why is the US destroying its own nation" and why many US politicians have gotten every rich during or after public office.

Yes. "We are now seeing the absolutely crazed idea of the cashless state", where governments and banks can steal your electronic money so much more effortlessly - just by a few keystrokes - all in the name of saving us from "terrorists" or other impending "disasters".

What we are seeing is near the end of a long process of corruption. False economic education has been used effectively to lobotomize the population, with "efficient markets", "money neutrality", "deficit spending", "monetary stimulus", "equilibrium economics", "risk management", etc., so that their wealth can be quietly stolen and they become enslaved with debt. Most have a "trained incapacity" to look and not see what is obvious to you and me.

The purpose of my blog is to scientifically falsify much of what passes as scientific knowledge in economic education - a push back against theoretical justifications for harmful policies. I am doing what I can do. This may eventually have an impact on consciousness. But in the short-term, the madness continues while the looting and plundering are still possible - I hope not for long.

If optimism is possible, it is that, if those in power are corrupt and immoral, then sooner rather than later thieves will set upon thieves and the collapse will come from within the rotten core. There are already signs of fracture ("a small event Q4 2015"?). Unless the madness escalates (if "the elite are not just drawing the line, but are attacking") and not voluntarily abandoned, the damage is still contained at this stage, which will largely mean broken social promises, diminished pensions and savings and not catastrophic global destruction.

Australia "should be better off than most nations" but it needs to be more than a lapdog of America.

The Clinton years were indeed an anomaly. The budget surpluses that his administration was able to run at the time may have another interpretation. That is, growth was bubble driven, which had corresponding impacts on tax revenues, and consumption and investment decisions. The lowering of the interest rate to stimulate consumption was at least part of the cause of the rise of the housing bubble which followed. (Dean Baker: http://www.cepr.net/publications/op-eds-columns/there-is-no-santa-claus-and-bill-clinton-was-not-an-economic-savior?highlight=WyJiaWxsIiwiYmlsbCdzIiwiYmlsbCciLCJjbGludG9uIiwiY2xpbnRvbidzIiwiY2xpbnRvbiciLCJiaWxsIGNsaW50b24iXQ==)

One need only note the close cooperation between the Federal Reserve and the TBTF banks. On reflection I prefer Bill Black's term for them - Systematically Dangerous Institutions, or SDI. Still, private banks have been able to create credit and debt on their own, without the cooperation of a central bank. In the US, this occurred most recently in the years from 1836 (Charter of 2nd Bank of the Unites States not Renewed) to about 1913 - the creation of the Federal Reserve. That pattern fits admin's story as well - a credit over-expansion, often in the form of the over issue of notes or over extension of loans, followed by a credit and economic collapse. Whatever the instabilities, the net result was the creation of US industrial power, built on the rail network and the discovery of oil and the emergence of the domestic steel industry. Note the complexity - they mutually condition one another, and the emergence of large industrial firms necessitated the emergence of large banking and financial firms along side them. The key point is that for the most part, the financial sector was subordinated to the needs of the industrial sector - at least until the 1920's. Today, finance is an end unto itself, and has a large role in destroying 'real' investments that would improve people's lives.

The distinction between public and private investment may be quite important. The level of government also plays a role. State and local governments can not issue money - that right is reserved for nations. So in many ways, they are forced to act much more like a for profit business than a national government that can issue its own currency, or issue bonds (debt) denominated in that currency. A nation like the United States, as admin points out, faces no technical constraint on its ability to create money. This could be used for a more functional health care system in the US, to rework the education system in the US, both of which have the potential to dramatically improve the lives of people living in the US if done right. The government could issue bonds to do this, and that would be the corresponding debt. The asset might be difficult to measure except by using the debt incurred as a proxy, but debt incurred by the government to rework health care and education results in increased productivity and better lives and education for the people, which could be regarded as the corresponding asset. Instead, we have the emergence of financialization and the bankruptcy of both political parities. A nation in 'extremis' indeed, to use Peter's analogy.

Peter is in many ways on point, which means that those on opposite sides of the political spectrum are beginning to see the same set of problems. If this continues, there will be a big shake-up in the political landscape coming down the pike. He makes much the same point as a number of writers on the World Socialist Web Site, usually in their deliberately polemical last paragraph(s). The analysis of the different treatment of Greece and Ukraine fits is with both Peter's reply and admin's original post. (http://www.wsws.org/en/articles/2015/06/13/pers-j13.html)

Jeff,

As always, you have raised some interesting points worth noting and commenting on.

True, the later part of the 1990s was financially affected by the dotcom bubble and probably has boosted tax receipts. I have not investigated the details. In any case, Clinton could have spent the windfall. But instead, he decreased outlays - a deliberate policy of balancing the budget - much to the anger of Uber-Keynesians such as Dean Baker.

Dean Baker is political and careless with facts. He blamed the dotcom bubble on Clinton when monetary policy was tightening in his years with Fed Funds rate going from 2.9 percent to 6.4 percent from December 1992 to December 2000. Rates started to fall only from January 2001, after Clinton. Then Dean Baker blamed Clinton for the housing bubble and the "over-valued" dollar of the Bush years - unbelievable. My research paper contains such details.

But the actual details are secondary to the primary message of the macroeconomic fact, which is: "austerity", including balancing budgets, raising interest rates and paying down debt, does not necessarily lead to economic slumps, just the opposite happened in the Clinton years. I am personally no fan of Clinton, but facts are facts. Academics always want the government to spend more money, not less, on them - they are political and biased.

The US health care system and the education system (you mentioned) are merely vehicles for making money. The amount of fraud from over-servicing, bogus claims, etc. has made US health care one of the most expensive in the world. The education system is a factory for selling qualifications which are produced at the lowest cost for profit. Failure of the education market means many graduates have little job prospects, created with a trillion-dollar student-loan bubble.

Banks are indeed dangerous institutions. The US Federal Reserve was created secretly by the private banking cartel, which has used the debt money it creates "out of thin air" and illegally (according to the US Constitution) to corrupt the US government and everywhere else. This is part of "using money to make money" which is finance. As you say "finance is an end unto itself".

Financialization has unleashed the imperative of making money as an end in itself, which does not, or needs not, have anything to do with real investment, economics or wealth creation. Should it surprise anyone that the US economy is in decline and wealth has been destroyed?

Economics is full of self-serving factions (RWER, INET etc.) and continues to be irrelevant for solving economic problems. Academics prefer to argue about empty theories, ignoring facts and contemporary issues. Economics education is an intellectual liability for students some of whom now populate central banks!

Greetings,

I make comment to bring to your attention, a somewhat old work in fundamental behaviours of humanity which has rather startled me, as the finding and conclusions that are to be found therein, agree with my thesis which I have been evolving over numerous decades. To be clear I posit that "Economics" can be found at its roots in the behaviours of humanity, and to be brief, there is a next step upwards looming in the mental capacities of men. This has been stated in an ancient work; another work in which I am involved in the etymological translation and interpretation of over the past few years. Validation indeed along with the definition of terms that are haunting our Society today with their mindless invalidity and course demeanor.

May I ask you to source a copy on-line as a PDF and which is available for free d/l. If you have difficulty you could email me at peter dot j dot bolton AT g mail dot com

Please remove the appropriate meaningless terms that bot find difficult to parse.

MANHOOD of HUMANITY

BY

ALFRED KORZYBSKI

AUTHOR OF SCIENCE AND SANITY

An Introduction to Non-aristotelian Systems

I received these documents 5 years ago and have only begun to read them recently. Manhood of Humanity is my priority.

kindest

peter

MANHOOD of HUMANITY

BY

ALFRED KORZYBSKI

AUTHOR OF SCIENCE AND SANITY

An Introduction to Non-aristotelian Systems

Some comments:

Man in his development today, remains is the state of proto-Human; an immature step in his evolutionary process of maturity. The attending consciousness of this state has been "intelligence" - not "Intellect", and this destructive by nature and necessarily so for the natural development of the higher planes of technology. Intelligence and Intellect are not of the same ordering, the former being divisory, material and destructive while the latter, holistic and spiritual (for want of a better term). We are at the end of this Technology evolution and are, as I have posited 'oft enough, about to enter the Intellect Epoch, the Epoch of the mature, or evolved, Human Being.

Extract page 145

"It must be emphasized that the development of higher ideals is due to the natural

capacity of humanity; the impulse is simply time-binding impulse. As we have seen, by

analysing the functions of the different classes of life, every class of life has an impulse to exercise its peculiar capacity or function. Nitrogen resists compound combinations and if found in such combinations it breaks away as quickly as ever it can. Birds have wings—they fly. Animals have feet—they run. Man has the capacity of time-binding—he binds time. It does not matter whether we understand the very “essence” of electricity or any other “essence.” Life shows that man has time-binding capacity as a natural gift and is naturally impelled to use it. One of the best examples is procreation. Conception is a completely incomprehensible phenomenon in its “essence,” nevertheless, having the capacity to procreate we use it without bothering about its “essence.” Indeed neither life nor science bothers about “essences”—they leave “essences” to metaphysics, which is neither life nor science."

I would add, that our Universe is knowledge based dynamic construct - in volume- and that knowledge evolves through complicity, where: "Complicity is an energized and vital interaction of two or more complex systems in a feedback arrangement which leads to a behavior that is not present in either system on its own. Complicity is the mystery of transmutation or coagulation - a spagyric event. (verbewarp). But evolution we know moves - as all phenomena throughout the Universe - in Principle, by differentiation. Man, that is to say, contemporary man, in the main, is proto-Human, due to evolve to the next stage, identified and defined in ancient texts, that is to the elevated or higher ordering as Human Being; Man the Accomplished.

We must learn to view all causal events as Principles; Universal Principle and Parochial Principles. Conception is but an Universal Principle.

Indeed, the Human is no animal and never was an animal nor a result of a liaison with an animal but a creation identified and named "Adam" or Humanity. As such, man as a unique species of life, is subject to its own unique set of Laws and Functions.

The message being that man must stop its subjugation to the Laws of animals. At this time whilst acknowledging the existence of the Higher Ordering of Natural Laws - the proto-Human will be able to claim his birthright of Manhood as the Human Being.

This thesis represents the portal to the future. I was about to prepare the outline for such a document to be written by myself, commencing next month, but now I find it already complete. There are many validations, of course, that I have achieved that I could add to strengthen these arguments, but, they are really unnecessary; this thesis stands rock-solid by itself.

An extremely important work.