Over-consumption is not in the Keynesian lexicon. More consumption is assumed always to be better for economic growth (with few exceptions) in a Keynesian prescription of perpetual demand-stimulation policy of quasi-boom (Keynes, 1936, p. 322):

Thus the remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the so-called boom to last. The right remedy for the trade cycle is not to be found in abolishing booms, and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keep us permanently in a quasi-boom.

In his theory, Keynes was guided by a central idea – “an axiom which only half-wits could question” – which Hayek (1983) explained was “that general employment was always positively correlated with the aggregate demand for consumer goods.” As Keynes (1936, p.104) stated:

Consumption – to repeat the obvious – is the sole end and object of all economic activity. Opportunities for employment are necessarily limited by the extent of aggregate demand.

Consumption Stimulation

For decades, the Keynesian policy of consumption stimulation has been followed consistently in many countries, particularly the US (see below). Specially in the current economic slump, the government policy has been to encourage more spending – a Keynesian prescription which is frequently, widely and approvingly repeated by central bankers (Dudley, 2014; Yellen, 2014), academics (Krugman, 2014) and journalists (Coy, 2014). The main public debate is about how effective the various government policies have been to induce more private spending.

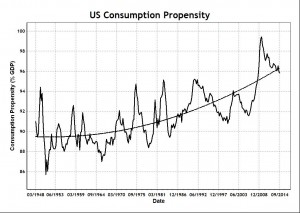

In the shadow of the Great Depression, few would deny the possible existence of under-consumption or doubt the Keynesian intuition that consumption may stimulate investment and economic growth (Skousen, 1992, pp.19-21). The government can increase aggregate consumption either directly through government spending, or indirectly through its policies on taxation, interest rates, business and consumer regulation, to induce private spending. Decades of demand-stimulation by US government policy have succeeded in creating a secular trend of ever increasing aggregate consumption propensity. Personal consumption expenditure alone went from a low of 59 percent of GDP in 1951 to a high of 69 percent in 2011.

Consumption refers here to the aggregation of private consumption, public consumption, consumption of fixed capital and net consumption of imports from the external sector using published data from the Bureau of Economic Analysis (BEA, 2014) for the US economy. The trend line is computed from least-squares fitting with a quadratic polynomial.

It is irrelevant for our purpose here to discuss issues such as inflation, employment, government fiscal and monetary policy and how they all interact and cause the secular trend rise in US consumption propensity. All that matters here is to have established the empirical fact that US government policy has been highly successful in executing the Keynesian prescription of demand stimulation to cause increasing consumption.

The Keynesian Paradox

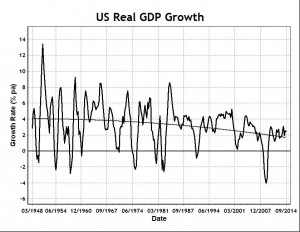

The Keynesian assumption is that increased consumption will eventually lead to increased investment and the establishment of a new equilibrium with increased economic growth, through the effects of the Keynesian multiplier (see below). The above data suggest US economic disequilibrium has an unsustainable trend, as indicated in an earlier post. Contrary to Keynesian expectations, the rising consumption propensity in the US economy has been accompanied by a secular decline in economic growth for more than forty years (Sy, 2014). The decline would have been steeper and more obvious had it not been for the continual injection of exogenous capital into the US economic flow (Sy, 2014c).

This Keynesian paradox is the conundrum of how the consumption demand-stimulation theory of economic growth can be reconciled with the above observation that ever rising propensity to consume has been accompanied by a secular decline in economic growth. To resolve this paradox, a single-sector macroeconomic model in disequilibrium, with saving withdrawal and injection, has been developed in a new research paper. In this model, the economic growth rate ![]() has been derived from accounting identities and is given by

has been derived from accounting identities and is given by

![]() All variables are time dependent,

All variables are time dependent, ![]() is the investment multiplier, c is the propensity to consume and s is the propensity to save, which is a rate in the flow equation but is related to the stock of saving. It is the intervention by the government through fiscal and monetary policies which directly or indirectly determines the exogenous component of national income flow which causes the observed disequilibrium.

is the investment multiplier, c is the propensity to consume and s is the propensity to save, which is a rate in the flow equation but is related to the stock of saving. It is the intervention by the government through fiscal and monetary policies which directly or indirectly determines the exogenous component of national income flow which causes the observed disequilibrium.

The Investment Multiplier

In the previous post, it was suggested that, due to US over-consumption, Keynesian economic collapse would have occurred during the global financial crisis had it not been for more saving and new credit injection into US economic flow to augment national income. The suggestion of over-consumption is proved here by deriving empirically a formula for economic growth as a function of the consumption propensity.

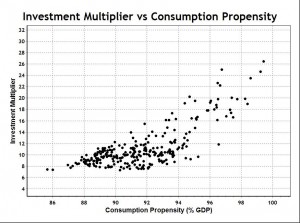

The above growth rate equation can be used to calculate empirically the investment multiplier as a function of the propensity to consume.

The above empirical evidence supports the Keynesian intuition that increasing consumption does indeed stimulate the economic multiplier effect of investment, because the investment multiplier appears to increase monotonically with the consumption propensity. But the functional dependence is not consistent with Keynesian theory which states (Keynes, 1936, p.115):

![]() with k being the Keynesian multiplier. The data show no signs of a singularity of the investment multiplier at c = 100% . Equating the investment multiplier to the Keynesian multiplier is the Keynesian fallacy discussed an earlier post.

with k being the Keynesian multiplier. The data show no signs of a singularity of the investment multiplier at c = 100% . Equating the investment multiplier to the Keynesian multiplier is the Keynesian fallacy discussed an earlier post.

Economic growth dependence on consumption can be estimated by modelling ![]() as a power function of c with

as a power function of c with

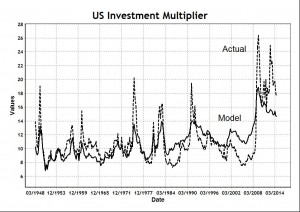

![]() where the parameter lambda is dependent on many other factors affecting the investment environment, which include factors such as, for example, profit opportunity, technology, regulation and availability of credit. A regression analysis of the model (Sy, 2015, Appendix A) shows the values that lead to the best least squares approximation to the actual data are

where the parameter lambda is dependent on many other factors affecting the investment environment, which include factors such as, for example, profit opportunity, technology, regulation and availability of credit. A regression analysis of the model (Sy, 2015, Appendix A) shows the values that lead to the best least squares approximation to the actual data are

As far as we know the US investment multiplier has been computed empirically for the first time here and evidently it ranges historically between 8 and 26, but mostly between 10 and 12. The spikes correspond to economic slumps when the propensity to invest typically fell harder than the economic growth rate. The details and implications may be discussed elsewhere.

Optimal Consumption

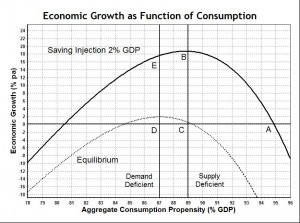

For a given saving injection into the economic flow, the model investment multiplier can be used to calculate the nominal economic growth rate using the above equation. The model growth rate as a function of the consumption propensity has been calculated for two values of saving injection: (s = 0) and (s = -0.02), corresponding respectively to equilibrium (with no injection) and to a two percent GDP annual capital injection into the economy.

Historically, the US economy has operated to the right side of the diagram, with the trend consumption propensity increasing from 90 percent to 96 percent (see the first figure above), with trend saving injection increasing from -1 percent (saving withdrawal) to 4 percent, directly to stimulate the economy (Sy, 2015).

Keynesian policy has pushed the US economy further and further into the region of supply deficiency or over-consumption where production from net investment has been insufficient to supply the goods and services needed to meet the level of consumption demand. Demand stimulation has been counter-productive in the regime of over-consumption. The split between consumption and investment in the current US economy is 96/4, which is far from the empirical optimal split of 88/12.

The left part of the diagram to the left of the vertical lines is the region of demand deficiency or under-consumption where the level of consumption demand for goods and services is insufficient to absorb or stimulate the supply of production from net investment. This is an empirical validation of the Keynesian intuition of under-consumption conceived in the shadow of the Great Depression.

Conclusion

The Keynesian paradox has been resolved by showing empirically the existence of an optimal level for the consumption propensity, which implies the existence of regimes of under-consumption and over-consumption. These distinct regimes of demand deficiency and supply deficiency are also important in resolving the long-running controversy between the supply-side Say’s Law and the demand-side Keynesian theories.

Evidently, the Great Recession which followed from the global financial crisis could not have come from demand deficiency, as the US economy was already in the over-consumption regime. Further demand-stimulation applied in recent years has exacerbated the problem of supply deficiency; it has hindered endogenous growth in the US economy and has exacted enormous costs in wealth consumption and in growing national debt. Instead, US government policy should be directed at re-balancing the supply and demand structure of the economy by increasing the ratio of real net investment to consumption. This is the policy prescription required to avoid the Keynesian economic collapse.

It seems to dovetail nicely with the Savings=Investment Fallacy post, and the paper on the contradiction in Keynes It also emphasizes an idea that I try to share with my students using a production possibility frontier - as crude and imprecise as it is.

A society could have too many investment goods, and too few consumer goods, so that its population starves, dies off early, or otherwise does not enjoy life to the full extent possible in that time and place with the given technology. It is also possible to have too many consumer goods, so that you may have a bout of riotous living for a while, but at the cost of maintaining and improving your productive capacity - i.e though investments in basic education, health, and scientific research.

I confess I am still having a problem understanding the claim that in order for one person to save, it is not necessary for another to spend. I can see that even with a banking system that this could be true, since it could be accompanied by a reduction of aggregate demand in a monetary, market economy. I could see it in a system with a central bank that created a bunch of money that was then used to bail out banks that were thought to be too big to fail. Depository institutions are currently still sitting on a near record level of excess reserves in the U.S. I could see it in a subsistence economy where a family might hold back seed for the next planting season, or dry meat now for consumption later. But I still get the feeling that I am not understanding you on this.

I blame my economics training.

Jeff, Thank you for your comment.

I will clarify the facts as far as possible - in science, facts are more important than theories - a topic I will write more about in future.

So far, I have discovered three main facts which contradict Keynesian theory.

First, equilibrium theory cannot be used to describe the empirical data. Possibly a main reason is that the government is continually intervening in the economy. Most economists are trained with the equilibrium assumption with intersecting supply and demand curves, which are a handicap in understanding a disequilibrium reality. I'm not the first person to identify this fundamental fallacy in economics generally (see e.g. Kaldor, 1972; Robinson, 1985), but I may be the first to point this out from examining the long-term data.

Secondly, many other fallacies follow from the equilibrium fallacy. In equilibrium, certain economic variables are in balance or are equal. But because they are in fact not equal, equilibrium theory cannot help to understand why they are not equal or how they will equilibrate, no matter how good is the verbal calisthenics.

Factually, saving is not equal to investment. Further, saving is not even equal to spending (consumption or investment). It is not possible to understand saving from an equilibrium framework, because saving is both the cause and the effect of disequilibrium. Or to put this more bluntly, net national saving is possible only in disequilibrium.

Standard teaching that "for one person to save another has to spend" is a simple fallacy arising from equilibrium assumption localized in time. For example, suppose I harvested 100 tons of corn, consumed 70, replanted 10 and saved 20 in a silo. My saving has nothing to do with spending of anyone else. In the next season, if I had a bad harvest of only 60 tons of corn, I can then withdraw my saving of 20 tons from the silo, spend 10 tons to maintain my consumption of 70 tons and invest the other 10 tons for replanting for the next season. My saving has been a temporal transfer of spending from myself to myself.

In the long-run saving equals expenditure, in the sense that what is saved will be spent eventually. But a particular saving at a particular time can be spend for either consume or investment, at any time and/or at any place, by any person or party (with intermediation). If my 20 tons of corn in the silo were lend out to another village, then we would have a contemporaneous transfer of spending to another person in another location.

Depending on the amount the saving or dis-saving an economy undertakes at any given time, any economic equilibrium will be affected, with saving usually reducing growth and dis-saving increasing it. Fluctuating withdrawals and injections of saving would prevent economic equilibrium which hardly exists in the data.

The financial system including the central bank and depository institutions is the equivalent of the corn silo. It can influence the quantity of corn stored in the silo by "interest rates" charged for storage or borrowing, it can limit the amount of corn available for borrowing, but it cannot create the demand for the corn in storage. The financial system can cause contraction, but cannot by itself cause an expansion of the economy.

Thirdly, only at equilibrium is the investment multiplier equal to the Keynesian multiplier. This cognitive error is the Keynesian fallacy which could lead to a Keynesian economic collapse when there is insufficient past and future saving injection to prop up the economy. In the absence of other changes, the end of quantitative easing and a rise in interest rates could lead to this collapse.