Pluralism is the enemy of science. At any given time, science deals only with a single most correct theory in any particular domain, not with multiple incorrect theories. There is a huge difference between evaluating many new ideas and the uncritical tolerance of many inconsistent ideas, which is what economic pluralism really is. Economists usually criticize each other privately and avoid open confrontation in public, giving a misleading impression of the unity of economics. The global financial crisis (GFC) has been seen (e.g. Economist, 2009) as a failure of the dismal science of economics, because mainstream economics is assumed to be science, with all its mathematical models and statistical analyses.

But mainstream economics is not science – it only pretends to be – which is why it failed. The heterodoxy of the fringe has been using the disrepute of “economic science”, which is actually scientism (Hayek, 1974), to revive the failed economic philosophies of the past in a move back to pluralism (Fullbrook, 2008). Future economic education will then be to teach more of past failed theories which have not been properly buried. This development would increase cognitive dissonance.

Cognitive dissonance is so great in economics that heterodox economists seem not to recognize that pluralism need not be revived, because it has never gone away. Economics is pluralist. Many different economic schools (e.g. Heilbroner, 1998) have continued to survive and even thrive judging by the books and the large number of articles published in many different economic journals – too many in fact. Neoclassical economics has had greater influence in recent decades because its computer models seem more relevant in the information age; they provide policy makers with new technological tools for decision-making.

To assume that neoclassical economics alone is responsible for economic policy and alone responsible for the GFC is further evidence of cognitive dissonance. For example, Fullbrook (2008, p.6) attributes the shortcomings of economics to “the lack of pluralism”, in that “the problem is not neoclassical economics itself, but its monopoly position”. In recent decades, particularly before the GFC, because neoclassical economics got most attention and research funding in universities, many academics assumed that it was the neoclassical economic policy of “neoliberalism” which alone caused the GFC, without looking at the facts, as will be done in this post.

Actually, economics is pluralist and economic policy in the real world is not monopolist, but pluralist. Economics is not science, partly because it is pluralist. Resource allocation in most economies uses many different methods inspired over time by different economic theories of the market and the government. The influences of different economic theories are captured in various economic policy legislation enacted over decades, as will be discussed below for the US economy.

It is pluralism – an unresolved melange of conflicting theories – which leads to cognitive dissonance, which is responsible for policy flip-flops over decades and a “trained incapacity” to recognize facts. For example, many heterodox economists associate neoclassical economics with extreme capitalism to which they attribute rising wealth inequality in the United States and other countries (Piketty, 2014). Below, this assumption will be shown to be empirically false.

But the empirical data over the decades show (see below) that the US economy has become progressively less capitalist, and more socialist, with the government taking a larger and larger share of the economy. It is assumed popularly that bigger government leads to social equality. It will be shown that the rising wealth inequality in the United States is due less to capitalism than to creeping socialism – with a surprising twist of how this has happened. Far from neoclassical economics having a monopolist or even dominant position in theory or in policy, market-based ideas actually have had only partial influence in the US government – the rhetoric is not the reality.

Policy Pluralism

Politicians and policy makers are mostly pragmatic people who have been elected or selected based on their political bias and they are always looking for new ideas to differentiate themselves from their opposition and to promote their political agendas. It is precisely the pluralism of economic ideas from academic scribblers which has led to the policy pluralism in existence today, as Keynes (1936, p.383) noted famously:

The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else.

Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.

The ideas of economists are powerful, but unscientific. Practical men do not bother with the pedantry of logic or science – they are interested in using whatever fits their purpose. Ideas are tools to be used and discarded according to circumstances. Academic scribblers are too happy to supply an abundance of arbitrary ideas for which they feel no responsibility – it is caveat emptor to journal editors and publishers. Consistency and coherence in the actions of practical men and in their consequences are of little concern, as the history of economic policy legislation shows (see below).

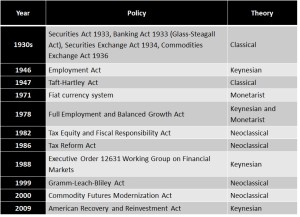

Real-world economies are based on variable mixtures of policies inspired by many conflicting theories – for example, free-market capitalism, Keynesian socialism and monetarism all play their part in US economic performance of the past eight decades. The table below shows some formal legislation influenced by those ideas.

Economic Pluralism

It is unnecessary to repeat tediously what is already known about the history of the above mentioned legislation, except to show that they have their basis in economic pluralism and that they are substantially the causes of the crisis today. Those legislation enabled and obliged the government and its agencies to control and manage more and more of the US economy, even as they are motivated by changing ideas which may be mutually inconsistent – including, paradoxically, deregulation by an interventionist government.

Early last century, classical economics of free-market capitalism prevailed in the US in stark contrast to socialism and communism elsewhere, particularly in the Soviet Union. The 1929 stock market crash and the Great Depression appeared to confirm the Marxist warning that capitalism is inherently unstable. A raft of legislation was introduced in the 1930s to regulate the financial markets. Particularly noteworthy was the Banking Act (1933) which included the Glass-Steagall Act, essentially forbidding commercial banks from undertaking investment banking or financial speculation.

Keynes (1936) had another explanation for economic instability, not based on class exploitation by capitalists, but based on the uncertainty and irrationality of investors, leading to inadequate macroeconomic demand which, he suggested, the government should manage. Keynesian economics is based on the assumption that the government should ensure economic growth and employment by stimulating consumption demand through fiscal and monetary policy.

The influence of Keynesian economics after the Second World War (WW2) was evident in the Employment Act (1946), which made the US federal government responsible for economic stability and employment. However, to ensure the labour market has greater wage flexibility according to the principles of classical economics, the Taft-Hartley Act (1947) was legislated to limit the ability of trade unions to go on strikes, “to promote the full flow of commerce”.

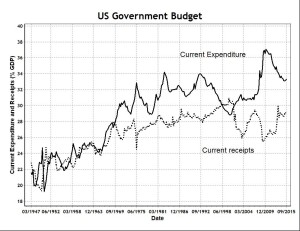

The size of US government, measured by total government expenditure relative to its gross domestic product (GDP), increased from 20 percent to 30 percent by 1970. By the early 1970s, it was clear that there was a structural gap between government income and expenditure to fund the needs of a welfare state (see the chart below). The quantity theory of money, also called monetarism (Friedman, 1970), suggested that inflation can be controlled by the money supply. Since inflation was thought to be linked tightly to employment through the Phillips curve relationship (Phillips, 1958), money supply can be therefore used to control employment through inflation.

But the post-war gold standard constrained the growth of the money supply and therefore limited government control on welfare, warfare, inflation and employment. The gold standard was abandoned by Nixon in August 1971 by suspending “temporarily” the convertibility of the US dollar to gold at $35 per ounce. As Greenspan (1966) noted:

The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit…In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.

Since 1971, the US monetary system, by extension through the Bretton-Woods agreement, has operated a global monetary system based on the US dollar, a purely fiat currency, which the former French Finance Minister (later President), Valery Giscard d’Estaing, called an “exorbitant privilege”. Agreement with the Saudi royal family to price their oil in US dollars had created a petro-dollar hegemony lasting to today.

The ensuing high inflation of the 1970s together with high unemployment was the stagflation phenomenon inexplicable by Keynesian economics, in a refutation of which Lucas and Sargent (1978) said:

… our intent is to establish that the difficulties are fatal: that modern macroeconomic models are of no value in guiding policy and that this condition will not be remedied by modifications along any line which is currently being pursued.

The assumed tight trade-off between inflation and employment (Phillips curve) proved to be a factual fallacy which required new legislation to enable government policy to uncouple them and to allow monetary authorities to choose between priorities and evils. The Full Employment and Balanced Growth Act (1978), also called the Humphrey-Hawkins Act, enabled Paul Volcker to apply his shock therapy to curb high inflation, regardless of its assumed impact on employment.

By 1981, Keynesian economic fallacy was widely recognized when Reagan declared in his inaugural presidential address:

In the present crisis, the government is not the solution to our problem. The government is the problem.

This saw more policy attention being paid to government budgeting in legislation such as Tax Equity and Fiscal Responsibility Act 1982 and Tax Reform Act 1986. The intention was to curb the ever rising tax receipts and government expenditure, in order to reduce the economic impact of government.

The chart below shows that the Reagan government succeeded largely in stabilizing current tax receipts from its citizens, but not current expenditure. Unless stated otherwise, the data used in this post are published by the US Bureau of Economic Analysis (BEA). In this case, the data from BEA Table 3.1 are used in the chart below.

As is well-known, the failure of the Reagan government (1981-1989) to reign in expenditure led to persistently large budget deficits, to the delight of some Keynesian economists. The size of government measured by total government expenditure to GDP continued to increase, indicating creeping socialism. The empirical data also dispel the heterodox myth that recent economic woes were caused by neoclassical economics or neoliberalism dismantling the socialism and welfare state of the 1950s and 1960s – the era of nostalgic Keynesianism which never ceased.

Cognitive dissonance remained unrecognized when economists made superficial attempts to unify fundamentally contradictory theories through neoclassical synthesis or New Keynesian economics, where microeconomics of market equilibrium was used to analyze the macroeconomics of government policy. The undesirability of government intervention in markets in neoclassical economics was to be reconciled with the desirability of government management in Keynesian economics.

Ironically, large and persistent budget deficits from Keynesian intervention were facilitated by privatization of government enterprises, which was influenced by the belief that those enterprises could benefit from the market efficiency preached through neoclassical economics.

Keynesian Financialization

Neoclassical economics argued for less government interference in markets, but by default, left macroeconomics to Keynesians. The ability to run government budget deficits in the modern economy was facilitated by financialization which allows debt creation with minimal constraint from real economic factors of production. Keynesian economics was made possible by financialization, with its origins in neoclassical economics.

Innovations in financial derivatives created the illusion that risk management is a science like physics, and led to “light touch” regulation and deregulation in financial services. In 1986, on taking up the chairmanship of the US Federal Reserve, Greenspan was relieved to find his “libertarian opposition to most regulation” was shared by his staff when he recalled (2007, p.373):

What I had not known about was the staff’s free-market orientation, which I now discovered characterized even the Division of Bank Supervision and Regulation.

The free markets of neoclassical economics were not the same as the highly intermediated markets in financial services – the vital differences were ignored. Financialization and deregulation led to the creation of new debt securities and an explosive growth of debt in the Greenspan era and subsequent eras when continual monetary stimulus of Keynesian and monetarist theories was maintained.

Not only did the debt growth fuel increasing leverage in the stock markets and their bubbles, there were also constant streams of initial public offerings (IPOs) from the privatization of the government enterprises, often benefiting insiders. Neoclassical faith in markets was behind the deregulation of the labour market and the privatization of many government enterprises, providing income streams from asset sales to fund additional spending from government budget deficits (see Figure below).

The first inkling of the financialization fallacy came in October 1987 when the innovation of “portfolio insurance” materially contributed to the stock market crash. The reaction was to consider the event as an unpredictable exogenous shock and the remedy was Executive Order 12631 Working Group on Financial Markets (1988), a legislation which allows the government to intervene and stabilize financial markets through the creation of the “Plunge Protection Team”. This government intervention would be consistent with the Keynesian economic view of irrational investors causing market dysfunction. But this would contradict the neoclassical view of free-market efficiency.

In practice, governments treat markets as efficient by deregulating them, but intervene when they fail, as a policy compromise between conflicting economic theories, reflecting economic pluralism. Financial scandals in the 1990s such as Gibson Greeting, Orange County, Metallgesellschaft, Barings, Long-Term Capital Management (LTCM), Enron, etc. were largely brushed off as accidents in neoclassical economics, not indicative of any serious flaws of financialization.

Confidence in financialization was formally legislated in the Gramm-Leach-Bliley Act (1999), which repealed the Glass-Steagall restrictions. Certainty in risk management through derivatives was legislated in the Commodity Futures Modernization Act (2000), which deregulated the over-the-counter (OTC) derivatives markets. These acts in the new century were votes of confidence of the booming stock markets and rapidly growing economies at the time, delightful to neoclassical and Keynesian economists alike.

Of course, the boom soon turned to bust, in the collapse of the so-called dotcom bubble. The efficient markets of neoclassical economics had to be rescued by government intervention with easy monetary policy of Keynesian and monetarist economics. But the easy monetary policy, coupled with financial innovations in mortgage securitization, led several years later to housing bubbles in many countries, many of which have collapsed since 2008, creating the Great Recession.

Again, the economic slump was seen to require Keynesian action, with the government intervening by reducing official interest rates to the lowest level rationally possible – zero. In case this monetary measure was insufficient, old-fashioned fiscal pump priming was legislated through the American Recovery and Reinvestment Act (2009), which was the Congress-approved Obama stimulus package worth $787 billion.

The combination of Keynesian government intervention and neoclassical market-deregulation and financialization continues to this day, with monetary easing directly through increasing the quantity of official currency – called “quantitative easing”. Direct manipulation of the quantity of money has to be added to the price manipulation of money, with interest rates having reached zero-bound. These measures are further supplemented by market management of the “Plunge Protection Team” whenever efficient markets fail to be efficient by collapsing. Government management of free-markets is an oxymoron enabled by economic pluralism.

This post, showing the influence of pluralism, forms the first part of a research paper where the second part shows how cognitive dissonance of pluralism leads to a policy of creeping American socialism, which is largely unrecognized.

Is pluralism an enemy of science? Yes. Is pluralism the worst enemy of science? No. To discuss this, it is helpful if we consider three possible scenarios for the future of economic science.

The first is a continuation of the status quo, where mainstream economics dominates, but a sizeable heterodox community exists. There is little or no communication between these different branches, and little mutual respect. The mainstream generally ignores heterodox writings. The heterodox community dissents from mainstream views and calls for reform.

Why does this heterodoxy exist? There are at least two possible reasons. One is that heterodox economists, who are reluctant to bury their favourite obsolete economic theories, exploit the state of confusion to keep these theories alive. This is usually unhelpful. The second is that empirical economists find evidence that contradicts mainstream theories (but the mainstream refuses to accept), so they join the heterodox community to keep the evidence alive. This is the good side of heterodoxy.

Then let us consider two alternative scenarios.

A) Ideal science. This calls for a change in attitude on all sides. Mainstream economists decide that for the sake of their science they should engage with the contradictory empirical evidence offered by heterodox applied economists. If it contradicts their theories then these need to be revised or abandoned. Heterodox economists, equally, decide that they need to consider whether their favourite theories are consistent with all evidence, and if not, they too must revise or abandon such theories. The outcome is no longer pluralism, but something closer to the ideal model of science in which a single most plausible theory dominates, until something better comes along.

B) Heterodoxy is driven from the discipline. This may happen if the mainstream economists use their political clout and greater numbers to assert that heterodox works are not reputable as they do not earn the recognition and approval of mainstream peers. This means that heterodox economists will be ignored, at the very least, and may actually be driven out of the discipline. A recent, and pretty uncompromising statement of this view was given by Tirole. He appears to say that not only are heterodox economists unworthy to remain in the economics discipline, but they should not be allowed to apply for refuge elsewhere (http://assoeconomiepolitique.org/wp-content/uploads/TIROLE_Letter.pdf):

“Breaking up the community of French economists by creating a refuge for a disparate group, in trouble with the assessment standards that are internationally acknowledged, is a very bad answer to the failure of this group in its effort to have its works validated by the great scientific journals, that prevail in our discipline.”

Scenarios (A) and (B) are both alternatives to pluralism, but they work in quite different ways, (A) embraces the insights and evidence gathered by heterodox economists to improve mainstream economics. (B) embraces nothing, and only gets rid of the 'problem' of pluralism by removing and thereby silencing heterodox critics of the mainstream.

Which of these three scenarios is the most desirable for the sake of economics as a science? I think most would agree that (A) is the best. And which is the worst? In my view, (B) is definitely worse than the status quo.

Pluralism is one enemy of science, but not necessarily the worst enemy. The worst enemy of all is the attitude that the mainstream can deal with contradictory evidence and ideas by removing the source of these ideas and evidence. This is not a scientific solution, it is only a political solution.

Pluralism is unsatisfactory as a long-term outcome in science. But the status quo may be acceptable as a stage on the path towards Scenario (A). Scenario (B), on the other hand, is a disaster. It gets rid of pluralism, but it cannot advance science in the manner of Scenario (A), because it destroys essential evidence.

Peter, Thank you for alerting me to this development. As you may gather from the evidence of this blog, my view is that whether orthodox or heterodox, economics is unscientific. Joan Robinson's suggestion "scrap the lot and start again" is what I have been doing here to build a scientific economic paradigm.

Jean Tirole was kidding himself when he said: "... modern economics is permanently questioning its own hypotheses, it compares models with data, and discards theories that fail when confronted to the test of reality." The statement is quite false. But at least orthodox economics pretends to be science, which heterodox economics considers unimportant and undesirable.

Heterodox economists have displayed their hypocrisy when they have rejected several of my manuscripts which refute empirically Keynesian economics, with referee comments which are laughable - I'm an experienced referee myself, in physics as well as finance. Because economics is not science, the refereeing process doesn't work very well in economics. Peer reviews in economics is not quality review, but prejudice review, which explains the poor quality of many journal articles; most have no clear or firm conclusions.

I'm not sure about your "(B) is definitely worse than the status quo"; my reservation is based on the fact that heterodox economics deprecates science, creates a lot of noise and diverts attention from important issues. For example, with the world continuing in economic crisis, what should change in economic policy? Most heterodox ideas provide no new or different policy advice than those currently pursued and most heterodox ideas have no immediate practical relevance.

The idea that economics should be a science is an important first step. The next step is to show orthodox economics how to do science. The trouble with pluralism or heterodox economics is that it does not accept even the first step. I'm not sure that heterodox economics places any importance on "essential evidence", which is the crux of science. Orthodox economics theorizes with mathematical models and heterodox economics philosophizes with words, but both without sufficient facts.

In any case, I think everyone should be free to pursue their own ideas and beliefs. But the whole Tirole debate really revolves around funding, careers and advancing self-interest - getting the taxpayers to fund their pet projects. They should pause and ask themselves honestly whether they are doing anything useful for society or are they doing more harm than good.

On my comparison of the status quo with scenario (B) ….

I should have been more precise about who exactly in the heterodox community is (in my view) able to supply “essential evidence”.

I am defining heterodox economists as the residual set: i.e. all those who are not orthodox. This set contains a wide variety of different types. One of the things that Tirole says in his letter that I DO accept is that the heterodox community is quite disparate.

The people I had in mind are those applied economists who gather all sorts of empirical data, using all kinds of techniques, and who refuse to limit their attention to the only two empirical techniques approved by the orthodoxy (i.e. econometrics and experimental economics). I would classify myself as one of this type. We are probably only a small proportion of the heterodox community.

I believe that some of the data we have gathered in this way counts as “essential evidence” that can contradict theories – in the economics of innovation, at least. But the typical response from mainstream economists has been to sweep my observations aside and say that, “nobody takes that sort of evidence seriously”. The typical response from some/most heterodox theorists might well be just the same - I don't know. But in the economics of innovation, there is a group of heterodox theorists called evolutionary economists, and they DO tend to take my evidence seriously.

I don't know if that clarifies my point.

Peter, Your point is clear and of course, I agree with your definition of heterodoxy. Heterodox economics being the "residual set" was also my initial definition until I had contact with these people. Their idea of heterodoxy only refers to their own set of theories and ideas which are outside orthodoxy. For example, their heterodoxy does not include Austrian economics or most of what I have been doing in empiricism - they don't like facts being exposed, invalidating their ideas. They have hijacked and enfeebled the notion of heterodoxy.

Applied economics, like what you do, collecting and analyzing data are the "bread and butter" of science. Data, however collected, so long as they are genuine and accurate, add to the body of facts. What constitute facts has to be verified by different methods - pluralism in this sense leads to "essential evidence". At one time, Galileo's telescopic observation of moons revolving Jupiter was not regarded as valid empirical technique - "nobody takes that sort of evidence seriously".

Economists write an enormous amount of rubbish on methodology showing their pathetic understanding of science. They don't understand that gathering facts, even provisionally or redundantly, is vital for a scientific body of "essential evidence", far more important than theorizing, axiomatizing, mathematizing, ... For this reason, economics is pre-Ptolemaic, because there are not enough recognized important facts for theory to explain.

How could they theorize without facts? It took a few millennia of fact gathering for a Newton to appear, not just an instant "when the apple fell on his head". I'm writing a piece later to explain how economics has gone off the rails, epistemologically, from its inception.

Economists don't even understand what to do with a major empirical observation in economics: the Phillips curve. They haven't done much to verify whether it is a universal fact or not. If not, what are the precise conditions or requirements for it to be true or be a good approximation? Instead, they just assume it is true in their forecasting models and use them to justify monetary manipulation of the economy. Decades of economic nonsense are leading to ever increasing economic instability endangering the world.

That's very helpful. While I (and the data gatherers I want to survive) are in the residual set, we are definitely not members of that particular Heterodox Community.

Here is one example of the sort of evidence I collect which is ignored by the mainstream. I remeber it very well. A decade or so ago, I was external examiner for a PhD viva. The student had performed various econometric studies relating to the car industry. I felt that one of the econometric results (as I recall, to do with an apparent lack of economies of scope in car production) was implausible and I asked the student: "have you ever visited a car factory?" This was met with amusement by student and the internal, (I paraphrase): "don't be ridiculous". The student had obviously been trained that 'anecdotal' evidence of this sort was of no value. So I told the student that I had indeed visited a car factory around 1998, and was shown the Late Configuration Centre, where superior versions could be created by adding features to the basic model. That was, as I saw it, a way of creating fairly strong economies of scope from strong economies of scale. But to no avail, the student was unimpressed.

I don't doubt that such site-visit evidence is to some extent 'problematic': it is impressionistic and site-workers may put a spin on what they say for political reasons, and so on. But almost all economic data is 'problematic' And econometric results are often highly problematic - we have discussed this before.

But I find it truly incredible that econometricians at large, the supposed scientists in the economics community, can really believe that we learn nothing about car production by visiting the place where it is done, but only by correlating data collected by some third party.

Peter, I'm not surprised by your story.

Most econometric studies are about techniques, not economics. They show little real interest in the data, often not even mentioning clearly where they come from. Putting data to their econometric models is mostly an afterthought to show how the models could be used to fit data.

Most economists don't seem to know or care that their macroeconomic data do not come from a pure free-market economy, so that the data cannot be used with methodological individualism of neoclassical economics. That is the data do not reflect purely the behaviour of the individual representative agent. For example, the government is responsible for 20 percent (through welfare) of the data on personal consumption expenditure.

Economists have little real understanding or respect for data - that's why economics is not a science. Econometric facts they obtained from data are vague and unconvincing.

I meant to add one further point. I entirely agree with your point:

"They don't understand that gathering facts, even provisionally or redundantly, is vital for a scientific body of "essential evidence", far more important than theorizing, axiomatizing, mathematizing, ... "

and that this appalling gap in economic knowledge is a danger to the economy, and indeed, the world.